Welcome back to Dividend Dollars and congrats on making it through the first trading week of 2022! This week was mostly a down week for the market. This week’s slide quickened when the Federal Reserve indicated that they may be more aggressive on the timing of their first interest rate hike. Data releases show an increase in labor force participation and a huge rise in wage growth which are both economic statistics that encourage the Fed’s case for rate increases. In addition to that, we saw a lower than expected 199,000 jobs created last month. All these things affected the market this last week and may continue to produce more downside.

Even though markets had a rough week, our portfolio probably had its best week yet! We will dive into it here. Every week I write an update on the dividend portfolio so that we can track its progress. I will give an overview of the portfolio and its value, the dividends received, trades made, and any news or business announcements made that may be of interest to our positions.

Portfolio Value

To date, I have invested $5,165 into the account, the total value of all positions plus any cash on hand is $5,520.33. That’s a gain of $355.33 for a total return of 6.88% since inception. The account is up $126.50 for the week which is a 2.35% gain!

This is huge! We started building this portfolio on 9/26/2021 and have hit a gain of 6.88% in under 4 months. Within that same time frame, the S&P 500 has increased by 6.51%. It took nearly a quarter, but as you can see our portfolio is starting to beat the market. Let’s hope we can keep this up as we continue to add money and invest in good positions for the portfolio.

We added $175 to the account this week through adds in a couple of positions as you’ll see below.

Portfolio

Above is a dashboard of the portfolio as tracked through simplysafedividends.com. I use that for tracking forecasted dividend income, yield, annual income, beta, and dividend growth.

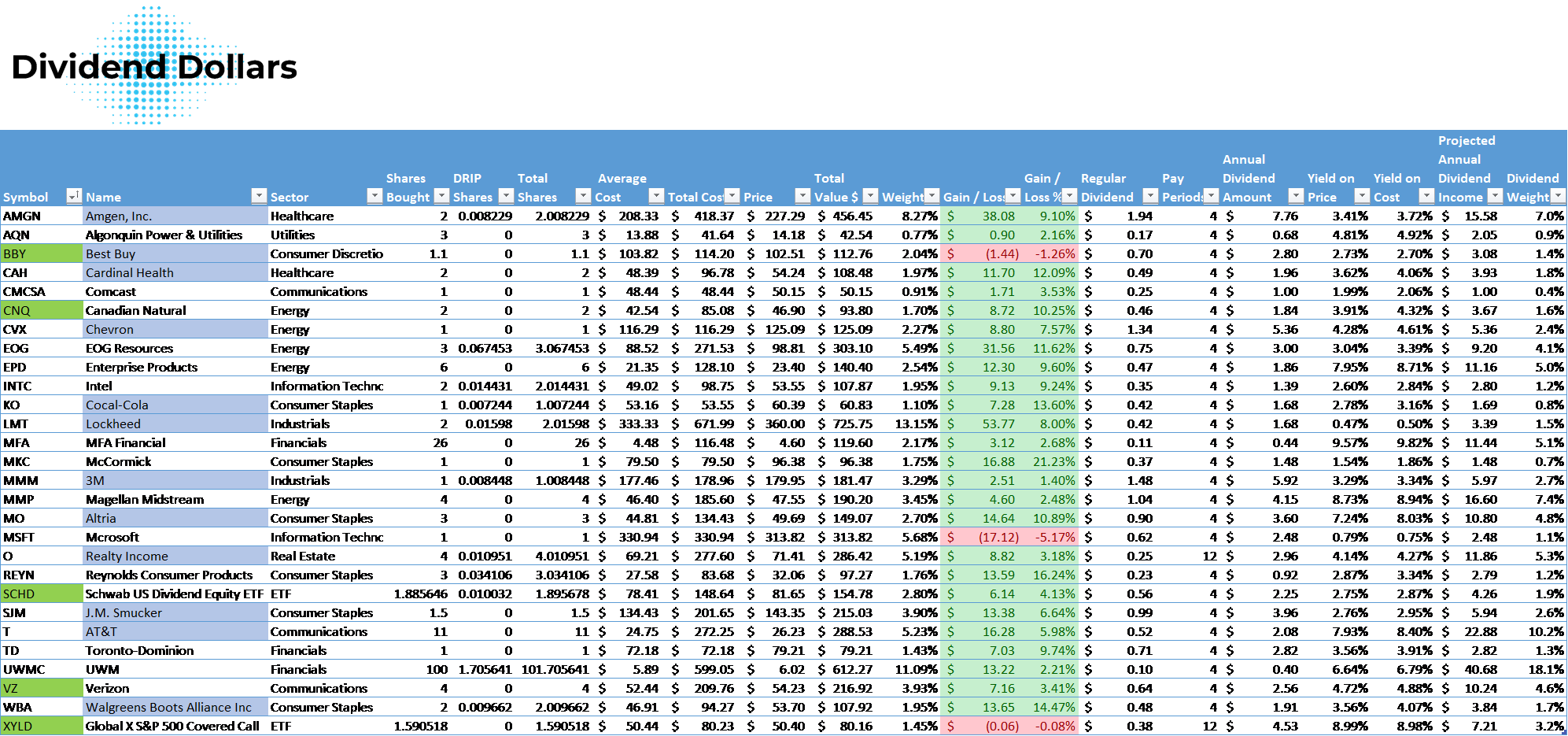

Below is an excel sheet that I use to track all of my positions. There you can see my number of shares, shares bought through dividends received, average cost, and gains. The tickers in green are stocks that I bought this week. Usually, a chunk of my buys throughout the week are buys from my monthly stock picks. You can read about January’s stock picks here. I use a stock screener to find potentially undervalued stocks with safe and growing dividends. All stock picks (for this month and previous months) are highlighted in blue.

This week our buys added $8 to our annual dividend income. Our dividend yield decreased by 0.11% and our beta went up by 0.01. Neither of those are particularly a bad or good thing. High dividend yields can mean that a company is paying too much in dividends and could be at risk of needing to cut dividends depending on the healthiness of the balance sheet. 4.41% dividend yield is a little higher than most dividend portfolios I’ve seen. Since I am young and just starting off, a high yield, though risky, gives me greater cash flow now to reinvest which will help me realize the benefits of compounding gains sooner.

Dividends

This week we received two dividends. $10.00 from UWMC and $0.64 from XYLD all of which were reinvested (XYLD will be reinvested at market open on Monday).

Dividends received for the week of January 7th: $10.64

Dividends received for January 2022: $10.64

Year-To-Date Dividends: $33.56

Upcoming dividends for next week are coming from MO and MKC.

Trades

Here’s the breakdown of the trades I made this week:

- January 3rd

- VZ – added 1 share at $52.32

- January 4th

- BBY – bought 1 share at $103.95 (new position on stock pick)

- January 5th

- XYLD – added $10 at $50.72 per share (weekly investment)

- SCHD – added $10 at $82.23 per share (weekly investment)

- January 6th

- UWMC – $10 dividend reinvested at $5.86 for 1.705641 shares

- January 7th

- ACC – sold 1 share at $55.39

- CNQ – added 1 share at $47.05

- BBY – added 0.1 share at $102.50

Noteworthy News

This section of the post will identify some headlines that may be of import to our positions. If they are important enough, we will also call out in the posts if the news calls for actions to readjust our portfolio. Unfortunately, I have been sick with COVID this week and did not spend much time watching the news, so nothing to share this week.

Summary

That is it for the update this week. Let’s kill it next week and keep our eyes open for more good buying opportunities! Let me know what you think of the progress so far, share with me your progress and questions, interact with me on twitter and Instagram using the links below!

Thank you for reading and here’s to an amazing 2022 of getting closer to financial freedom!