Welcome back to Dividend Dollars!

This week was a tad better than last with all indexes posting some minor gains. Data highlights this week included some strong job reports and rising treasury yields to finish us strong for the week.

Unfortunately, my portfolio didn’t fare so well and we will get into why! Every week I write an update on the dividend portfolio as we build it so that we can track its progress. I will give an overview of what the portfolio is invested in, its value, the dividends received, trades made, and any news or business announcements that may be of interest to our positions.

Portfolio Value

To date, I have invested $5,935 into the account, the total value of all positions plus any cash on hand is $6,120.91. That’s a gain of $185.91 for a total return of 3.13%. The account is down $61.98 for the week which is a flat 1% loss.

We started building this portfolio on 9/24/2021 and when compared to the S&P 500 we are outperforming the market so far! Within that same timeframe, the S&P 500 is up only 1.01%. Let’s keep up this good progress with smart adds to the portfolio.

We added $250 to the account this week. A significant chunk of that money added was put towards my position in 3M as you will see further down.

Portfolio

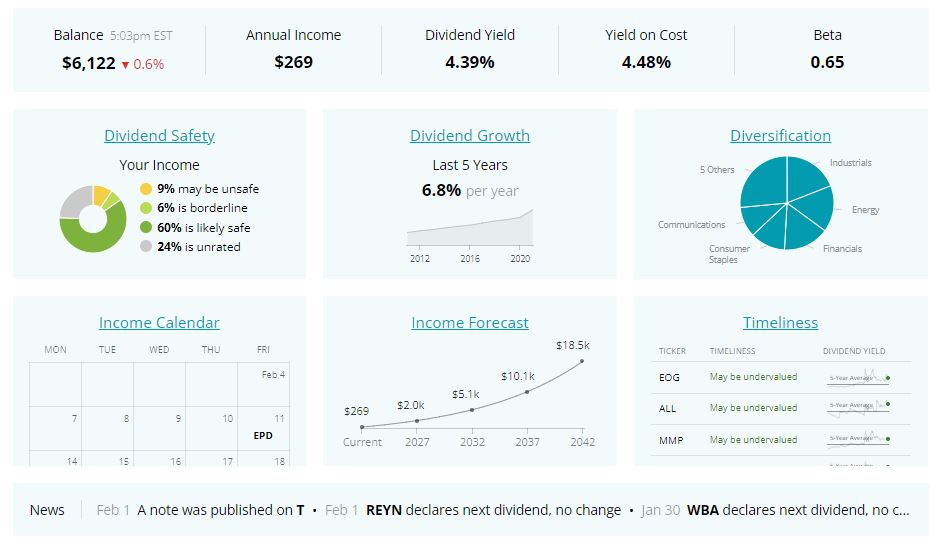

Above is a dashboard of the portfolio as tracked through simplysafedividends.com. I use that site for tracking forecasted dividend income, yield, annual income, beta, dividend growth, and more.

Below is a table of everything we are invested in so far. There you can see my number of shares, shares bought through dividend reinvestments, average cost, gains, and more. The tickers in green are positions that I bought shares in this week. Usually, a chunk of my buys throughout the week are buys from my monthly stock picks. You can read about January’s stock picks here (I know I am late but February’s picks will be here soon!). I use a stock screener to find potentially undervalued stocks with safe and growing dividends. All stock picks (for this month and previous months) are highlighted in blue.

This week our activity raised our annual dividend income by $14. Our dividend yield increased by 0.11% and our beta remained flat. My portfolio’s dividend yield may be just slightly higher than you will see in other portfolios, however that is strategic per my time horizon. I am in my 20s and am just starting off this investment journey, so a higher dividend yield gives me greater cash flow now to reinvest which help me realize the benefits of compounding sooner. Our beta usually hovers right around the mid 0.6s which I like, especially in times of uneasiness. It means my portfolio won’t dip as much as the rest of the market on red days, however, it does go the other way around and I won’t have as much green on the good days. Therefore, it is good to watch your beta in terms of cyclicity.

This week I just had to buy the dip on 3M following their poorly received earnings report. MMM reported $2.31 EPS beating the estimates by $0.29. Revenue has been relatively flat for the company for the last three years, yet the price has been declining. That seems unreasonable to me and this substantial dip gave me a good opportunity to buy!

Also, this week I added one share to my AT&T position following their update. T announced that they are cutting the dividend by 47% and are structuring their Warner Bros. deal as a spinoff instead of an exchange offer. The 47% dividend cut still keeps shares over a 4% dividend yield which is still attractive. The spinoff deal also will give shareholders 0.24 shares in the new entity for every share of T they own. As an investor who has only recently started building a position in T, this is great news. My position is only down 2%, my dividend yield is still strong following the cut, and I get a new (and fairly costless) position in the new WBD stock. I will keep watching for opportunities to add to T before the spinoff.

Both AT&T and 3M are both prior watchlist picks from last October, you can read that article here.

Aside from those two reasonable moves, I made more moves with UWMC. Shortly after starting this position it became the best position in my portfolio. It has quickly become my worst holding now, down 25%. I keep adding on the dips. I think long term, as long as leadership play their cards right to fix the float, UWMC will be a homerun. However, it must be watched extremely closely to make sure steps are being taken to get us there. I will read thoroughly their next earnings report and decide if an exit may be smart. But for now, we sit, wait, and collect the dividends and covered call premiums.

Dividends

This week we received dividends from MFA for $2.86, T for $5.72, VZ for $2.56, and XYLD for $0.96.

Dividends received for 2022: $9.24

Portfolio’s Lifetime Dividends: $53.69

Trades

Here’s the breakdown of the trades I made this week:

- January 31st

- MMM – added 1 share at $163.79

- TD – added $0.59 from dividend reinvestment at $80.08

- February 1st

- T – added 1 share at $24.30

- UWMC – added 4 shares at $4.88

- VZ – added $2.56 from dividend reinvestment at $53.56

- T – added $5.72 from dividend reinvestment at $24.24

- XYLD – added $0.96 from dividend reinvestment at $49.19

- February 2nd

- XYLD – added 0.203294 shares at $49.19 (recurring investment)

- SCHD – added 0.125826 shares at $79.47 (recurring investment)

- CMCSA – $0.25 dividend reinvested at $45.55

- February 3rd

- UWMC – added 6 shares at $4.40

Noteworthy News

This section of the post will identify some headlines that may be of import to our positions. If they are important enough, we will also call out in the posts if the news calls for actions to readjust our portfolio.

Last week had tons of news to share, and now this week I could not find anything worthy of sharing! Lots of earnings again for our positions but nothing bad or mind blowing!

Summary

That is it for the update this week. Let’s kill it next week. Stay patient and be ready to buy income producing assets at a discount!

Let me know what you think of the progress so far, share with me your progress and questions, interact with me on twitter and Instagram using the links below!

Thank you for reading! See you next week!