Welcome back to Dividend Dollars and our weekly review! And boy what ANOTHER rough week it was!

The S&P is down 3.3% for the week. The NASDAQ is down 3.9%, Russel is down 3.2%, and the Dow Jones is down 2.5%.

This week the market continued to feel economic pressure and also a spattering of poorly received earnings reports. Concerns about the tightening Fed policy in a low growth, high inflation environment continued to drive stocks down.

This week Apple (AAPL) alerted investors of looming higher costs due to supply chain issues for Q3. Amazon’s (AMZN) guidance Q2 revenue below expectations. Intel (INTC) also provided lower Q2 guidance during their earnings call. Overall, earnings was mixed with large losers in Teladoc (TDOC) and Tesla (TSLA) and with Meta (FB) being one of the stand out winners.

In terms of economic data releases, the Advance GDP report showed indicators of stagflation, regardless of historically low unemployment levels. Real GDP had decrease larger decreases than expected at 1.4% year over year. The GDP Chain Deflator increased by 8%. The PCE Price index jumped 0.9% for the month and 6.6% year over year.

Overall, a mixed earnings season and continued concern about recession and rising rates weighed markets down significantly this month, making this April one of the worst performing months in recent years. The Nasdaq Composite had its worst month since 2008 with a decrease of nearly 13.3%. The S&P lost 8.8%.

Thing’s were rough this month, and my portfolio was not immune from it! However, we added more than our regular deposit amount to our portfolio will continue to add while things are down. The best part about being a dividend investor is that performance is not the end-all be-all. It is nice to have capital gains, but we are in this to build income. While stocks stay down, we get to buy that income at a discount! And boy did we make some buys this week. Let’s dive into it.

Portfolio Value

To date, I have invested $8,428 into the account, the total value of all positions plus any cash on hand is $8,457.03. That’s a gain of mere gain of $29.03 for a total return of 0.34%. The account is down $251.25 for the week which is a 2.89% loss. In the last six weeks our portfolio has fallen from the highs of roughly 8% of gains!

We started building this portfolio on 9/24/2021 and when compared to the S&P 500 we are outperforming the market so far! Within that same timeframe, the S&P 500 is down -7.26% whereas our portfolio has an overall return of 0.34%! It’s tough seeing the portfolio come down from highs just a few weeks ago, but it is good that we are still beating the market.

We added $268 in cash to the account this week. The stock purchases made with this will be broken out below.

Portfolio

Above is a dashboard of the portfolio that tracks annual dividend income, yield, beta, dividend growth, and more.

Below is a table of everything we are invested in so far. There you can see my number of shares, shares bought through dividend reinvestments, average cost, gains, and more. The tickers in green are positions that I bought shares in this week.

This week our annual dividend income decreased by $17. The reason for this decrease is that I sold my position in UWM Corporation (UWMC) this week. It was a high yield and very risky position that I was using to experiment with selling covered calls. I was not doing a great job with the calls and my position was also down over 30% when I sold. I realized that this position was not in line with my investing style of building a portfolio of strong, established, dividend paying stocks. Therefore, I sold the position, took the loss, and rolled that money over into other positions which you will see in the trade break down below.

For my portfolio, it’s dividend yield may be just slightly higher than what you will see in other portfolios, however that is strategic per my time horizon. I am in my 20s and am just starting off this investment journey, so a higher dividend yield gives me greater cash flow now to reinvest which helps me realize the benefits of compounding sooner.

Our beta usually hovers right around the mid 0.6s which is good, especially in times of uneasiness. It means my portfolio won’t dip as much as the rest of the market on red days, however, it does go the other way around and I won’t have as much green on the good days. Therefore, it is good to watch your beta in terms of cyclicity. View the chart above to see the performance of my portfolio versus the S&P 500, notice how my portfolio’s green days are not as substantial as the S&P’s but neither are my red days, that is beta at work. My beta so far has led to better returns than the market since beginning this portfolio, however, on rally weeks I underperform. In order to combat that, I have started adding to a levered position to raise my beta. I would like to see it in the 0.8s.

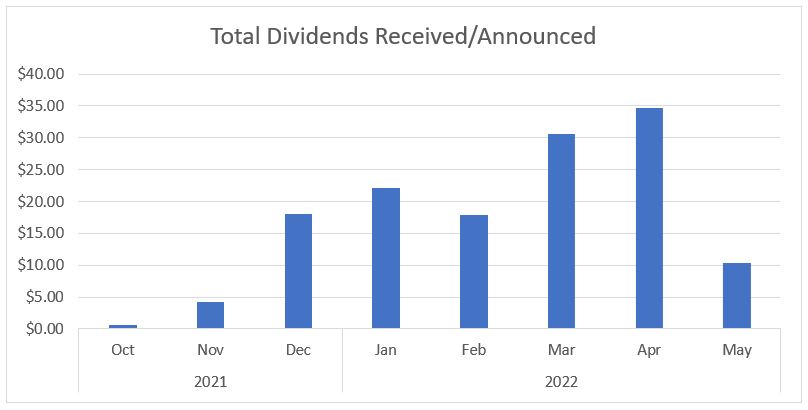

Dividends

This week we received five dividends. $0.74 from McCormick (MKC), $2.25 from XYLD, $1.35 from Comcast (CMCSA, click here to read the article I wrote on their quarterly earnings call), $2.34 from EOG Resources (EOG), and $4.55 from Altria (MO).

In my portfolio, all positions have dividend reinvestment enabled. I don’t hold onto the dividend, I don’t try to time the reinvestment, I just let my broker do it automatically. All dividends were reinvested.

Dividends received for 2022: $105.23

Portfolio’s Lifetime Dividends: $128.15

Trades

Below is a breakdown of my trades this week.

As noted above, we closed our UWMC position and used those funds to invest in many other down positions on Wednesday

- April 25th

- ETRACS 2x ETN (SMHB) – added 1 share at $9.80

- Cummins (CMI) – added 0.15 shares at $193.33

- Starbucks (SBUX) – added 0.25 shares at $77.40

- 3M (MMM) – added 0.15 shares at $146.93

- McCormick (MKC) – added 0.007229 shares at $102.37 ($0.74 dividend reinvested)

- April 26th

- UWM Corporation (UWMC) – sold all 155.957117 shares at $3.57

- ETRACS 2x ETN (SMHB) – added 4 share at $10.07

- XYLD – added 1 share at $47.44

- AT&T (T) – added 10 shares at $19.37

- 3M (MMM) – added 1 share at $143.36

- Starbucks (SBUX) – added 0.25 shares at $76.48

- Intel (INTC) – added 2 shares at $46.08

- Atlantica Sustainable Infrastructure (AY) – added 1 share at $30.89

- XYLD – added 0.04772 shares at $47.15 ($2.25 dividend reinvested)

- April 27th

- Texas Instruments (TXN) – added 0.25 shares at $163.76

- Comcast (CMCSA) – added 0.031513 shares at $42.84 ($1.35 dividend reinvested)

- SCHD – added 0.129289 shares at $77.35 (recurring investment)

- XYLD – added 0.210275 shares at $47.56 (recurring investment)

- April 28th

- Comcast (CMCSA) – added 1 share at $40.89

- April 29th

- Intel (INTC) – added 1 share at $44.10

- Realty Income (O) – added 0.1 shares at $71.00

Summary

That is it for the update this week. Let’s kill it next week. Stay patient and be ready to buy income producing assets at a discount!

Let me know what you think of the progress so far, share with me your progress and questions, interact with me on twitter and Instagram using the links below!

Thank you for reading! See you next week and stay safe!

2 replies on “Dividend Portfolio: 4/29/2022 Week in Review”

what tool you use for the portfolio dashboard?

It is from simplysafedividends.com