Welcome back to the weekly Dividend Dollars portfolio review! This portfolio update is brought to you by Sharesight, a portfolio tracking tool that I am happy to partner with. Their platform makes tracking trading and dividend history, understanding your performance, and saving time a breeze. I wrote a review of the product that you can read here if you’re interested in learning more! Click the link above or the picture below to get a special offer only for Dividend Dollar readers!

Happy New Years! Here at Dividend Dollars, our investing approach is a dividend growth strategy with aspects of value investing and fundamental analysis. I am a young investor in my 20’s and by sticking to this strategy over the long term, the magical powers of compounding are on my side. This allows me to more easily build substantial positions in dividend paying stocks over time, which will one day help me reach the ultimate goal of being financially free through the sources of passive income they provide. You can read more about the strategy here. Let’s dive into the portfolio review!

Portfolio Value

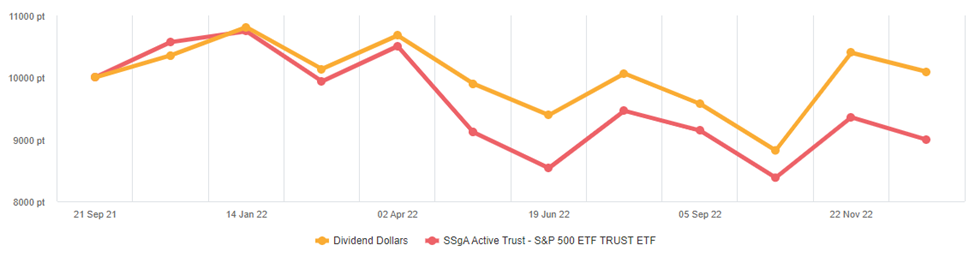

To date, I have invested $12,830 into the account the total value of all positions plus any cash on hand is $12,684.04. That’s a total loss of 1.314%. The account is up $33.16 for the week which is a 0.26% gain. Pretty flat week.

We started building this portfolio on 9/24/2021 and when compared to the S&P 500 we are outperforming the market so far! Within that same timeframe, the S&P 500 is down -13.83% which puts us 12.6% higher than the market! I love tracking my portfolio against a benchmark like the S&P. The above chart comes from Sharesight which makes portfolio and dividend management a breeze!

We added $60 in cash to the account this week, trades made will be broken out below.

Portfolio

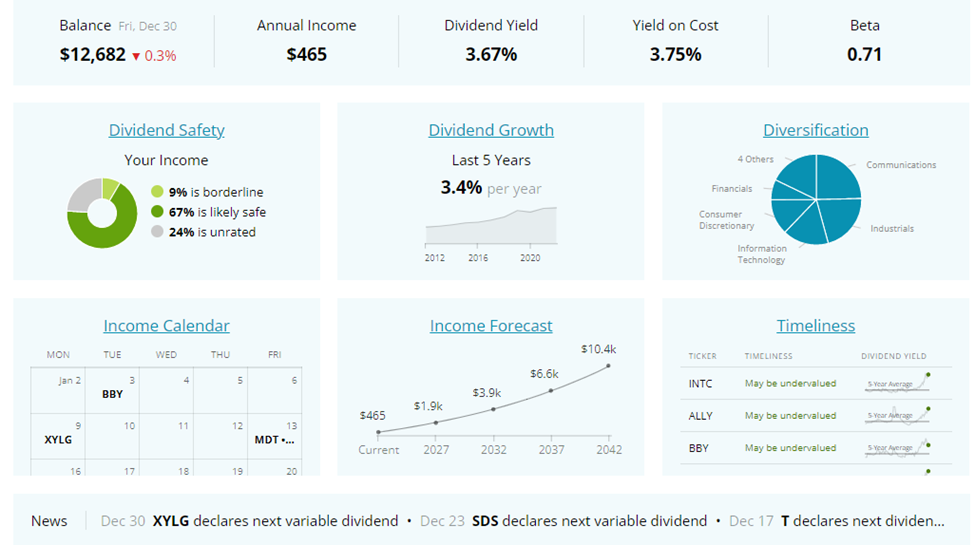

Above is a dashboard of the portfolio that tracks annual dividend income, yield, beta, dividend growth, and more.

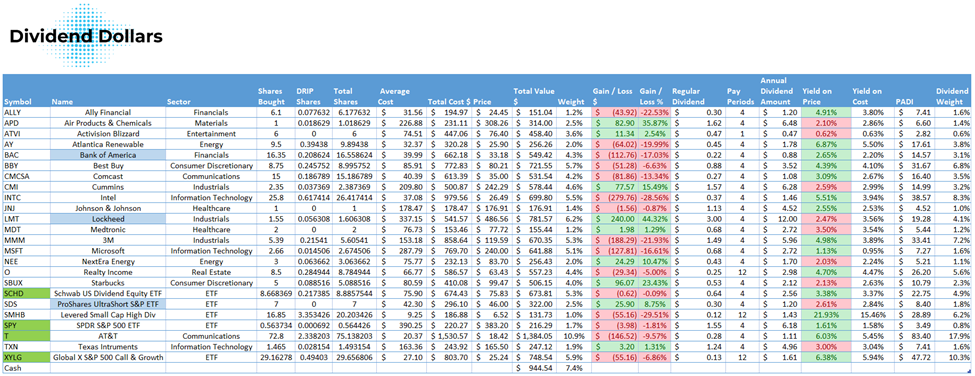

Below is a table of everything we are invested in so far. There you can see my number of shares, shares bought through dividend reinvestments, average cost, gains, and more. The tickers in green are positions that I bought shares in this week, the blue ones are positions that I reinvested dividends into, the yellow ones are positions that announced a dividend increase this week, and the red are positions that I trimmed. Our PADI this week decreased from $491 to $465. This is mainly because of a drop in the yearly payout from $XYLG following their most recent dividend declaration.

Dividends

This week I received 3 dividends, see the chart below. These will all be reinvested automatically on the next trading day.

In my portfolio, all positions have dividend reinvestment enabled. I don’t hold onto the dividend, I don’t try to time the reinvestment, I just let my broker do it automatically.

Dividends received for 2022: $387.48

Portfolio’s Lifetime Dividends: $410.40

Trades

This week was a slow one. I took the opportunity average down a little in AT&T and did my weekly buys in $SPY, $XYLG, and $SCHD.

Below is a breakdown of the trades I made this week:

- December 27th, 2022

- SPDR S&P 500 ETF ($SPY) – added $10 at $380.76 per share (weekly buy)

- Global X S&P 500 Covered Call & Growth ETF ($XYLG) – added $10 at $25.22 per share (weekly buy)

- Schwab US Dividend Equity ETF ($SCHD) – added $10 at $75.70 per share (weekly buy)

- December 28th, 2022

- AT&T ($T) – added 1 share at $18.48

Next week I will continue to add $10 into each ETF ($SPY, $XYLG, and $SCHD) and will continue to hold onto the rest of my cash until the market gets a little bit lower. I really want to deploy this cash position into $T, $CMCSA, and $INTC to build 100 share positions in them for covered call activities.

Summary

That is it for the update this week. Cheers to an awesome year in 2022 of outperforming the market and cheers to a great 2023 with many buying opportunities!

Later this weekend, I will write the final market recap for the year!

Let me know what you think of the progress so far, share with me your progress and questions, interact with me on twitter and Instagram using the links below!

Thank you for reading! See you next week and stay safe!

Regards,

Dividend Dollars