I apologize for missing the report last week, was out on vacation but we are back now and have TONS to cover!

This weekly market recap is brought to you by Koyfin, a powerful analytical tool that I am proud to partner with. Their platform is entirely customizable for whatever data you want to look at including stocks, ETFs, mutual funds, currencies, economic data releases (one of my personal favorites used often for these posts), crypto, and even transcripts of company events! Click the link above to get a special offer only for Dividend Dollar readers or go give my product review a read if you’re interested!

Weekly Market Review

It was a big losing week for the market as investors analyzed Fed Chair Powell’s testimony before Congress, the February employment report, and news of SVB Financial’s Silicon Valley Bank being shut down. All major indices ended the week down over 3.5%.

Monday started on an upbeat note with early gains being supported by positive moves in some mega cap stocks. Apple ($AAPL) was a leader in that respect after Goldman Sachs initiated coverage with buy rating with a $199 price target.

Under the surface though, there was some anxiousness felt as the market waited for key events in the week ahead. Even at midday, as the indices were trading near their highs for the day, the number of stocks declining was greater than the number of stocks increasing.

Mega cap strength started to face and selling ramped up in the Treasury market. The main indices were in a slow grind lower for the rest of the day.

Economic data for the day was only the January Factory Orders. This fell 1.6% month-over-month (consensus -1.8%). Shipments of manufactured goods increased 0.7% MoM after falling 0.6% in December. The key item in the report was the strength seen in nondefense capital goods orders, excluding aircraft. This criteria, which factors into GDP forecasts, were up 1.1% after a 0.6% decline in the last reading.

Tuesday started mixed with the market waiting for Powell’s testimony before the Senate Banking Committee. Both stock and bond markets reacted quickly to key comments.

Powell stated, “Although inflation has been moderating in recent months, the process of getting inflation back down to 2% has a long wat to go and is likely to be bumpy… the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes. Restoring price stability will likely require that we maintain a restrictive stance of monetary policy for some time.”

Powell’s Q&A portion afterwards added that data doesn’t suggest that the Fed has overtightened yet. Data suggests they have more work to do, increasing the likelihood that peek rates are higher than the Fed’s projections from the December meeting may be increased. The hearing and Q&A session ultimately suggested that a 50 point hike is back on the table. Markets moved lower throughout the day upon this news.

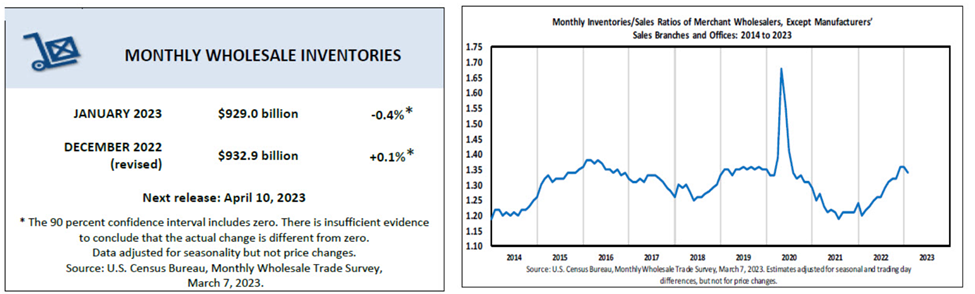

Data on Tuesday was the January Wholesale Inventories and the Consumer Credit reading. Inventories were down 0.4% MoM and was in line with expectations.

Consumer Credit increased by $14.8B in January compared to the expected $22.9B. The takeaway is that consumer credit expansion is slowing, likely a result of rising interest rates. The decrease was driven predominantly by revolving credit and was the 2nd lowest increase in the last 12 months.

Wednesday had the markets start off choppy as the second day of Powell’s testimony kicked off. Treasury markets signaled economic concerns with the 2 year and 10 year spread hitting its widest margin since 1981.

With that move, stock prices deteriorated and the major indices slipped closer to their lows of the day. They did close above the lows, though, thanks to mega-caps running in the last hour of the day. That momentum slowed with the S&P 500 neared its 50 day moving average ($3,997) which turned from support to resistance on Tuesday.

Economic data for the day included the Weekly MBA Mortgage Applications, ADP Employment Change, the JOLTs job report, and the January trade deficit reading.

The weekly MBA mortgage application index rose 7.4% with refinancing applications increasing 9.0% and purchase applications 7.0%.

The ADP Employment Change showed private payrolls rose by 242,000 in February against a 195,000 consensus. The January reading was revised upwards by 13,000.

The JOLTS Job Openings reading total 10.8M in January after a 0.2M upward revision for December.

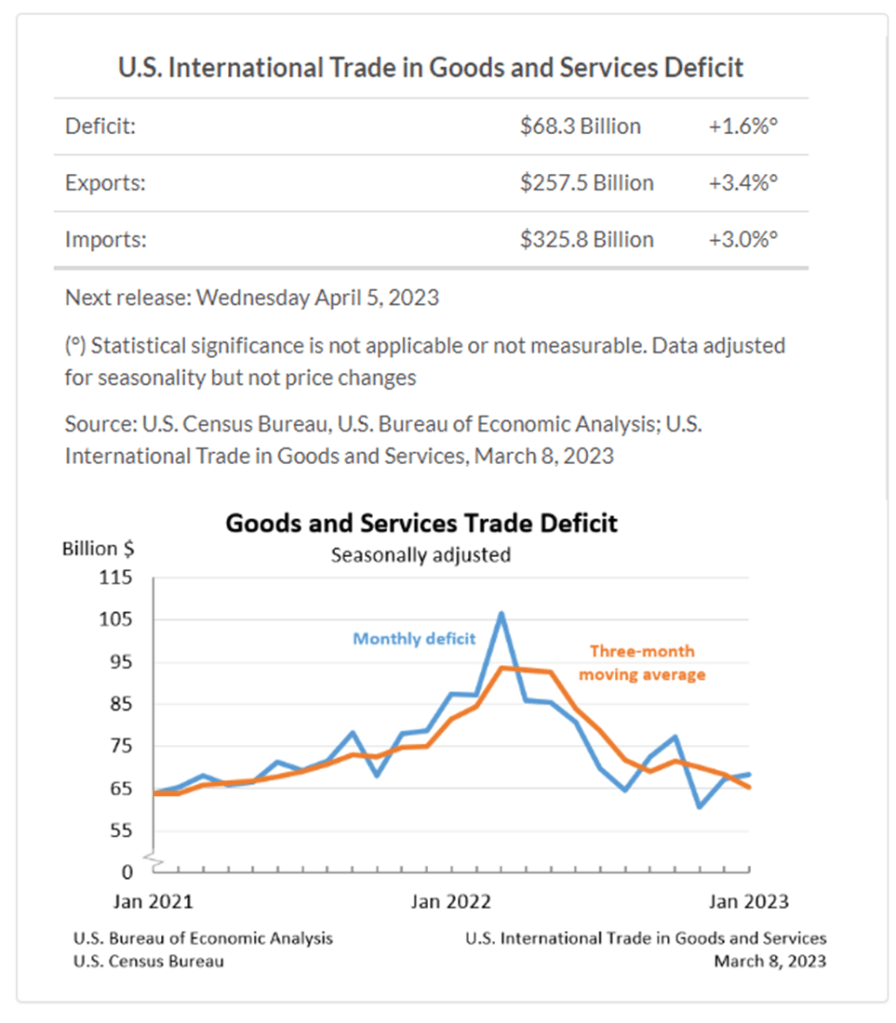

The trade deficit for January grew to $68.3B compared a consensus of -$69B. December numbers were revised upwards by $0.2B. Imports for January were $9.6B more than December imports. Exports were $8.5B more than December exports. The takeaway here is that both imports and exports increased compared to December, reflecting a pickup in global activity and demand.

Then Thursday came around, and the situation that we’ve all been watching unfold for days now had kicked off.

The day started green, lead again by mega-caps and hope that higher-than-expect jobless claims could be followed by a weaker-than-expected nonfarm payrolls reading on Friday.

Initial jobless claims for first week of March increased by 21,000 to 211,000 compared to a consensus of 198,000. Continuing claims increased by 69,000. This was the highest claims level since December and teased the idea of some labor softening. However, current claims levels still are at levels that are indicative of a tight labor market overall.

The opening was short lived as bad news and price action in the banking space weighed down the market.

The S&P 500 cut under its 200 day moving average and closed near lows for the session in a steady and broad based sell off.

Bank stocks took the bulk of the losses as concerns about rising rates, higher deposit costs, and weaker loan demand collided with the news that Silvergate Capital ($SI) is voluntarily liquidating and that SVB Financial Group ($SIVB) sought to raise capital through the sale of marketable assets at a loss and a potential stock offering to combat their increased cash burn.

The second part of that last paragraph was the main trigger of worries about the state of deposits and capital positions for smaller banks that drove major selling interest.

Ultimately, things break when the Fed is in an aggressive tightening cycle, and banks, whether or not they are involved in a specific problem, will get pulled into the downfall regardless of their roll.

Treasury yields also fell lower that day, yet stocks did not respond in the opposite way. This leads us to believe that the flight to treasuries was more of a flight-to-safety than anything else.

Friday opened considerably lower and kept that theme up for most of the day. The employment report brought some good news with nonfarm payrolls being strong and average earnings growth being weaker, but the SVB Financial situation was by far the largest driver of price action. A broad sell off brought the S&P 500 under 3,900 on big volume.

Silicon Valley Bank was shut down by the FDIC in the late morning. This is the second largest bank to get shut down by the FDIC since Washington Mutual in 2008.

The FDIC also created the Deposit Insurance National Bank of Santa Clara to protect insured depositors of $SIVB. This news followed earlier reports that the Founders Fund (Peter Theil’s VC fund) had advised companies to pull their money out of the bank and that deposit outflows were outpacing the process of selling SVB to a prospective buying banks.

Wide concerns about SVB’s troubles and their potential contagion effects continued the flight-to-safety in the Treasury markets on Friday.

Most views from analysts so far are that SVB’s situation won’t be a systematic banking problem given how well capitalized the system is. That said, the market saw a rebound effort squised after it was reported the SVB was being shut down. The market lost their hold and broad based selling picked up putting the S&P 500 to a low of $3,846.

The sudden collapse of SVB could leave billions of dollars belonging to companies and investors stranded. As of the end of 2022, SVB was the 16th largest bank in the US with just over $200B in assets. Their tech and start up focus has felt the brunt of the aggressive interest rate hikes by Fed.

The Treasury bond assets they sold on Thursday incurred a $1.8B loss as the value of those bonds fell with the rising rates, the value of their hold to maturity assets have incurred an even larger, though unrealized, loss.

The main office and all branches will reopen on Monday and all insured depositors will have full access to their insured funds. That is good news, however, roughly 89% of the banks $175B in deposits were uninsured as of the end of 2022. What happens to these funds is anyone’s guess.

We can assume that the FDIC is working this weekend to find a bank that is willing to acquire SVB. A merger by Monday could secure the safety of those uninsured deposits, but no deal is certain.

I have seen headlines that Roblox Corp ($RBLX) and Roku Inc ($ROKU) have hundreds of millions deposited with the bank. With most of these funds uninsured, share prices have dropped by a considerable amount.

Collectively, the banking sector has lost over $100B in stock market value from Thursday and Friday, with European banks also feeling some pain. Some analysts are forecasting more pain for the sector as hidden risks become more clear.

All eyes will be on the FDIC and if they are able to secure an acquirer for SVB or if they will be force to liquidate the bank.

Dividend Dollars’ Outlook & Opinion

That’s it for the recap. Now for my opinion!

To be blunt, this week was insane. The market made big moves down on the SVB news. Economic readings and Fed speak were worth paying attention, but when it really came down to it SVB and the concern it has caused for the banking sector has defined this week. It may even be the definitive moment for the year.

This week was so red that $SPX broke down through numerous key points. The week started above every key point of support, but quickly took them all out as the week came to an end. The market broke through the 50 day moving average first on Tuesday, then the 100 and 200 day moving average on Thursday, and broke down below the long term downtrend established at all time highs in the beginning of 2022 before testing the bear market level at $3,855.

Price action broke down below that level briefly before ending the week just above it at $3,861.86.

As you can see by the three circles I have on the chart, following significant breakdowns underneath the bear market level, the following days are extremely volatile. I expect the next fews days to not be an exception, if anything they’ll turn up the volatility as the SVB situation unfolds.

Up until this week, the market in 2023 has been playing red-light green-light with inflation readings and Fed meetings. Markets have been quick to react to every little item that gives insight into what the Fed will do moving forward.

Now we had a giant wrench thrown into that theme this week. Fed Powell’s testimony affirmed the position that Fed is willing to pick up the pace on rate hikes if economic data shows it is needed. Add to that, SVB has collapsed due to the effects that these rate hikes have had on them as bank and their customers. Granted, there’s a lot to pick apart and criticize with that situation as safe and sound banking strategies are not wholly evident, however, it is yet to be seen if this situation will change the Fed’s approach at all.

Will they remain focused on inflation and protecting the value of the dollar despite the giant problem on the horizon that is the SVB collapse? We will have to wait and see till the next rate decision on 3/22/23.

Because of this, the CPI report on Tuesday and the employment reports that follow may be difficult for the market to wrap their heads around the meaning of those readings. Anticipate a lot of volatility as all eyes are on this situation and Fed.

I anticipate more red next week, mostly due to investors being jaded by SVB and the effects on the market, but also as a result of the CPI and PPI reports. Forecasts for both are expecting an improvement on the MoM and YoY readings. If these come in higher than expected, expect the negative reaction to be larger than normal.

That’s it for my recap! Go check out my portfolio update to see how I am navigating these markets while building dividend-based wealth.

And if you like updates like this, follow my Twitter or my CommonStock page where I post updates on the economic data throughout the week.

Regards,

Dividend Dollars