This weekly market recap is brought to you by Koyfin, a powerful analytical tool that I am proud to partner with. Their platform is entirely customizable for whatever data you want to look at including stocks, ETFs, mutual funds, currencies, economic data releases (one of my personal favorites used often for these posts), crypto, and even transcripts of company events! Click the link above to get a special offer only for Dividend Dollar readers or go give my product review a read if you’re interested!

Dividend Dollars’ Outlook & Opinion

I’m switching it up this week and putting the outlook first as I believe the outlook content is more pertinent for the following weeks than a recap of historical information. The best information should always be at the top, right?!

Anyways, this was a light week for economic data. The most important figure, in my opinion, was the core PCE. This is the Fed’s preferred inflation gauge. While the reading’s MoM increase was exactly on target, the YoY level was +4.6%, just below the estimate and prior month’s reading at +4.7%. Like the other inflation metrics, this figure has been falling steadily for several months now. The takeaway here is that prices are not falling, however, they are rising at a slower rate. This is good news.

When this quarter began, you could probably count the number of bullish analysts on one hand. Objectively, it was not a great quarter, however, following a 19.4% decline in 2022, total rate hikes of 50 basis points, two significant bank failures and touching negative territory two weeks ago to finish the quarter up over 6% is wild.

With this rally to end the month, SPX is now higher than the long-term downtrend by the largest margin to date. SPX finished the week well above all significant moving averages, and inched above the 4,100 technical resistance level with some fast moves at the end of Friday.

Historically, markets tend to switch directions at the beginning of a new quarter and April tends to be a relatively bullish month. However, nearly missing a major banking crisis is still in the back of the market’s mind and the start of a potentially weak Q1 earnings season around the corner, it’s too early to tell if history will repeat itself.

Various indicators have improved and worsened through the course of this week. VIX and SPX open interest put call ratios improved into neutral territory, VIX and SPX open interest changes improved to moderately bullish levels. Meanwhile, major ETF and equity changes in open interest, and VIX implied volatility gaps have worsened to moderately bullish, neutral, and neutral territory, respectively.

In general, things are looking moderately bullish. There are a few more upgrades than downgrades this week, but some items contradict others, indicating increased volatility. With the next potential rate hike will not arrive till May, earnings season kicks off in a few weeks, and a dodged financial crisis looming over shoulders, traders may look to continue the buying spree, but not without some volatility.

Weekly Market Review

Q1 2023 ended with a bang. The S&P 500 spent most of the week above its 50-day moving average and the 4,100 level by Friday’s close. The indices stuck to a narrow range in the first half of the week, though, as investors continued to digest all the bank happenings of prior weeks.

Participants reacted favorably to news that First Citizens Bancshares ($FCNCA) will acquire some of Silicon Valley Bank’s and that authorities are considering expanding an emergency lending facility for banks. Bank stocks remained under pressure though. FDIC Chairman Michael Barr told the Senate Banking Committee that he sees needing to increase capital and liquidity standards for firms over $100 billion.

Overall, the S&P 500 financial sector rose 3.7% this week, but it declined 6.1% in Q1.

Some of the gains this week were pushed by strong leadership from semiconductor stocks. The iShares Semiconductor Index ($SOXX) rose 3.17% this week and surged 25.6% this quarter. The market liked Micron’s ($MU) earnings report, but prices fell back down on Friday due to reports that Chinese regulators are reviewing their products for security.

The rally charged ahead on Friday from relatively pleasing inflation data. The PCE Price Index slowed to 5.0% YoY in February from 5.3% in January. The core-PCE Price Index hit 4.6% from 4.7%. The direction of these moves is good news, but the pace of decreases could improve.

The U.S. Dollar Index fell 0.6% to 102.52. On that note, China and Brazil agreed to trade in their own currencies instead of the USD.

All 11 S&P 500 sectors ended the week green. Energy (+6.3%), consumer discretionary (+5.6%), and real estate (+5.2%) lead while communication services (+2.3%) and health care (+1.7%) trailed.

Monday:

The market started the day mixed. Sentiment around the bank sector shifted after investors learned that First Citizens Bancshares ($FCNCA) will acquire $72 bln of Silicon Valley Bank’s assets at a discount of $16.50 bln.

Additionally, a Bloomberg report indicated that US authorities are considering expanding an emergency lending facility for banks in ways that would give First Republic Bank ($FRC) more time to improve its balance sheet.

Despite the banking improvements, major indices closed mixed with NASDAQ trailing. They were feeling the weight of lagging mega cap stocks, which helped drive a 0.7% loss in the Vanguard Mega Cap Growth ETF ($MGK) versus a 0.7% gain in the Invesco S&P 500 Equal Weight ETF ($RSP).

There was no economic data of note on Monday.

Tuesday:

Markets were in relatively tight range on below average volume. Indices closed red after climbing above their worst levels in the afternoon. The Nasdaq trailed its peers again Tuesday, weighed down by lagging mega cap stocks.

Morning money flows looked somewhat similar to Monday’s with banks leading. Sentiment seemed to shift around the time that FDIC Chairman Michael Barr testified at Senate Banking Committee, suggesting more regulation.

Economic data for Tuesday contained the international trade in goods, the FHFA housing price index, and the consumer confidence reading.

The advanced report for international trade in goods showed a $91.6 billion deficit in February versus a $91.1 billion deficit in January. Retail inventories reflected a 0.8% build following a 0.1% from the prior. Wholesale inventories showed a 0.2% build after a 0.5% decline in January.

The FHFA Housing Price Index rose 0.2% in January following a 0.1% drop in December.

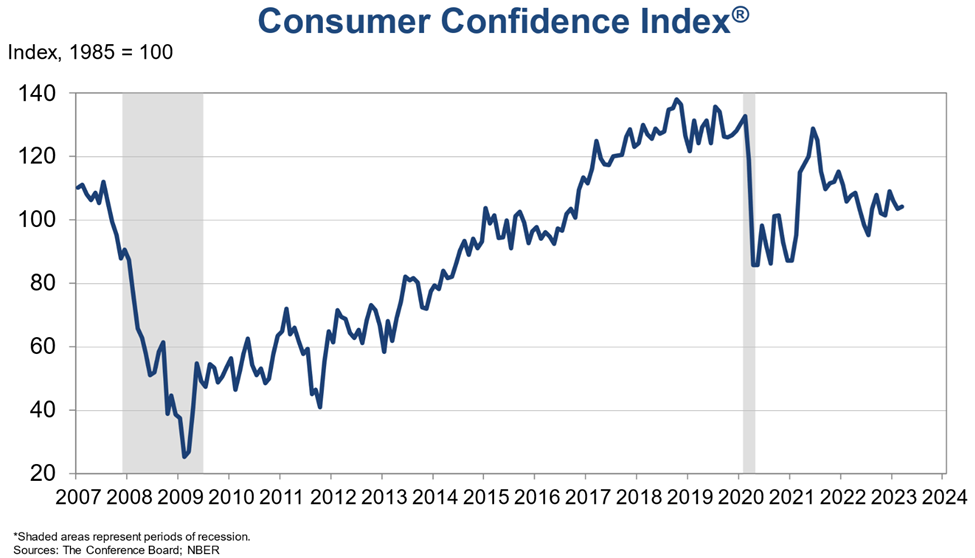

The Conference Board’s Consumer Confidence Index for March hit 104.2 above the expected 101.5 versus the 103.4 reading for February. Last year, the index was at 107.6.

The key here is that this survey included the period included the SVB fiasco and still help up well. However, the Expectations Index remained below 80 level for the 12th month out of the last 13, which serves as a concerning signal about future growth.

Wednesday:

Wednesday was a positive day following the 2-day Congressional hearing on the SVB bank failure. For most of the day, the main indices chopped around a range, albeit sporting nice gains. A late afternoon push higher had the main indices close near their highs of the day, leaving the S&P 500 above its 50-day moving average.

Nasdaq led thanks to strong mega caps and chipmakers. Micron’s ($MU) quarterly results pleased, and many semi stocks traded up with it.

Semi strength helped drive a 2.1% gain in the S&P 500 information technology sector, which closed near the top of the leaderboard of sectors.

Economic data for Wednesday included the MBA mortgage index and the pending home sales report.

The weekly MBA Mortgage Applications Index rose 2.9% with purchase application jumping 2.0% (-35% YoY) with refinancing applications rising 5.0% (-61% YoY). Improvements are being made, activity is still at historical lows.

Pending home sales rose 0.8% in February versus an expected 2.3% drop. This is coming off of the 8.1% increase from January.

Thursday:

At first, the main indices all logged decent gains led by the Nasdaq thanks to relative strength from chipmakers and mega cap stocks.

This faded and the main indices slowly fell, hitting their session lows around midday. The downturn was attributed to renewed selling pressure in bank stocks, indicating that concerns about additional fallout remain in play. The S&P 500 financial sector (-0.3%) was the worst performer for the day.

After the slump, the main indices bounced and closed near highs of the day. The S&P 500 was able to extend even higher above its 50-day moving average.

Economic data for Thursday included the initial jobless claims report and the Q4 2022 GDP estimate.

Initial jobless claims for the week ending March 25 rose 7,000 to 198,000 while continuing jobless claims for the week ending March 18 rose 4,000 to 1.689 million.

The key takeaway from the report is that claims remain at a stable level near the 200,000 mark, suggesting little recent stress in the labor market.

The third estimate for Q4 GDP showed a small downward revision to 2.6% from 2.7% reported in the second estimate. The drop was due decreases to exports and consumer spending. The personal consumption expenditures index was flat at 3.7% while the core-PCE Price Index was revised up to 4.4% from 4.3%. The GDP Price Deflator was left flat at 3.9%.

The key takeaway from the report is that it continues to show decent growth while inflation remains above the 2% target, which the Fed could use as an argument for additional rate hikes.

Friday:

The market ended Q1 with great gains. The indices moved up right out of the gate and spent most of the day trending higher. A sharp jump higher in the late afternoon had the S&P 500 close above the 4,100 level.

The run followed some pleasing inflation and consumer sentiment data in the morning.

Strength from the mega cap space pushed index levels high on Friday and throughout the quarter in genera. The Vanguard Mega Cap Growth ETF ($MGK) rose 1.8% versus a 1.5% gain in the Invesco S&P 500 Equal Weight ETF ($RSP) and a 1.4% gain in the market-cap weighted S&P 500. $MGK rose 18.9% this quarter versus a 2.4% gain in the $RSP.

Friday’s economic data included the PCE reading and the Michigan Consumer Sentiment Survey.

February Personal Income increased 0.3% while spending only increased 0.2%. February PCE Prices and Core PCE prices rose 0.3% with core PCE Prices.

The key takeaway from the report is that it only showed a slight deceleration in the YoY PCE and core-PCE price indices. Though things are moving in the right direction, one can argue the Fed still has room to raise rates.

The March Univ. of Michigan Consumer Sentiment hit 62, down from 63.4 in the prior.

The key here is similar to the other reading we saw, sentiment was relatively strong considering the SVB situation occurred during the survey period.

That’s it for my recap! If you would like to see how I am building my dividend portfolio using my predictions/strategy written here, you can read about my buys in my weekly portfolio update on this link.

And if you like updates like this, follow my Twitter or my CommonStock page where I post updates on the economic data throughout the week.

Regards,

Dividend Dollars