Welcome back to the weekly Dividend Dollars portfolio review! This portfolio update is brought to you by Sharesight, a portfolio tracking tool that I am happy to partner with. Their platform makes tracking trading and dividend history, understanding your performance, and saving time a breeze. Click the link above to get a special offer only for Dividend Dollar readers!

Here at Dividend Dollars, our investing approach is a dividend growth strategy with aspects of value investing and fundamental analysis. I am a young investor in my 20’s and by sticking to this strategy over the long term, the magical powers of compounding are on my side. This allows me to more easily build substantial positions in dividend paying stocks over time, which will one day help me reach the ultimate goal of being financially free through the sources of passive income they provide. You can read more about the strategy here. Let’s dive into the portfolio review!

Portfolio Value

To date, I have invested $11,650 into the account the total value of all positions plus any cash on hand is $10,133.61. That’s a total loss of -13.02% The account is down $349.01 for the week which is a -3.33% loss.

We started building this portfolio on 9/24/2021 (Woot Woot one year, read my one year reflection here) and when compared to the S&P 500 we are outperforming the market so far! Within that same timeframe, the S&P 500 is down -19.52% whereas our portfolio is down -13%! I love tracking my portfolio against a benchmark like the S&P. The above chart comes from Sharesight which makes portfolio and dividend management a breeze!

We added $160 in cash to the account this week, trades made will be broken out below.

Portfolio

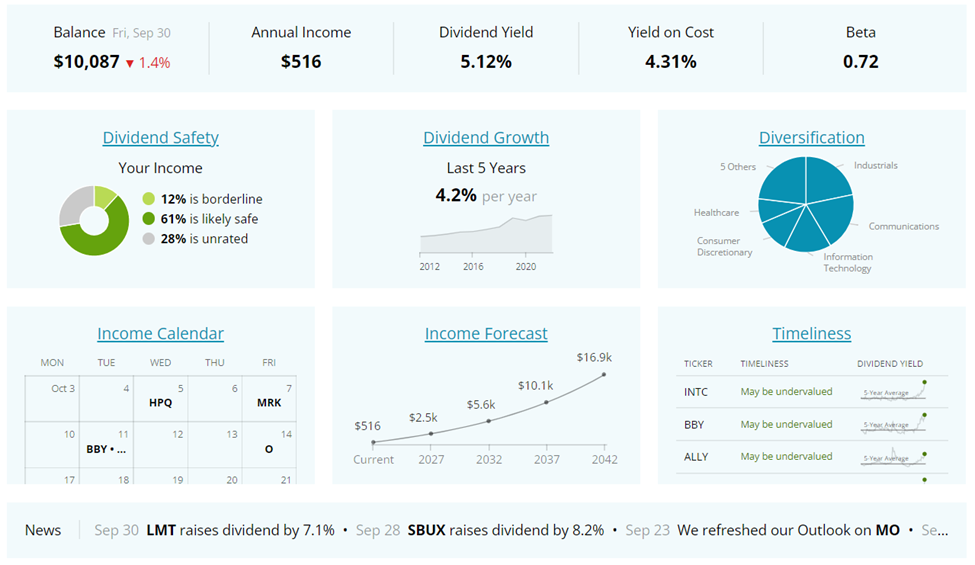

Above is a dashboard of the portfolio that tracks annual dividend income, yield, beta, dividend growth, and more.

Below is a table of everything we are invested in so far. There you can see my number of shares, shares bought through dividend reinvestments, average cost, gains, and more. The tickers in green are positions that I bought shares in this week, the blue ones are positions that I reinvested dividends into, the yellow ones are positions that announced a dividend increase this week. These moves increased our annual dividend income by $12 at a yield of 5.12%.

Dividends

This week we received $10.97 from three dividends: $4.35 from Schwab Dividend Equity ETF $SCHD, $3.01 from Global X S&P Covered Call & Growth ETF $XYLG, and $3.62 from Bank of America $BAC

In my portfolio, all positions have dividend reinvestment enabled. I don’t hold onto the dividend, I don’t try to time the reinvestment, I just let my broker do it automatically.

Dividends received for 2022: $289.19

Portfolio’s Lifetime Dividends: $295.75

Trades

Below is a breakdown of my trades this week! I was on vacation in Pennsylvania all week and did not make many trades, so this will be short and sweet.

- September 26th

- $SCHD – added 0.148765 shares at $67.22 ($10 recurring investment)

- $SPY – added 0.027477 shares at $363.94 ($10 recurring investment)

- $XYLG – added 0.410846 shares at $24.34 ($10 recurring investment)

- $SCHD – $4.35 dividend reinvested at $67.93 for 0.064041 shares

- September 27th

- $INTC Intel – added 1 share at $27.03

- $ATVI Activision – added 0.2 shares at $74.80

- $XYLD – $3.01 dividend reinvested at $24.35 for 0.123614 shares

- September 29th

- $O Realty Income – added 1 share at $58.83

- $T AT&T – added 2 shares at $15.63

- $INTC Intel – added 0.4 shares at $26.33

- $SMHB ETRACS 2xMonthlly Pay Leveraged US Small Cap High Dividend ETN – added 0.2 shares at $6.00

Next week I will continue to add $10 into each ETF ($SPY, $XYLG, and $SCHD) and will look at deploying the rest of the money either into $CMCSA for the upcoming ex-dividend date and then probably average down into some more $INTC, $T, and $MSFT possibly.

Summary

That is it for the update this week. Let’s kill it next week. Stay patient and be ready to buy income producing assets at a discount!

Read the weekly market review to get a recap of the week and what economic events are coming in order to help arm yourself with a strategy for your future buys!

Let me know what you think of the progress so far, share with me your progress and questions, interact with me on twitter and Instagram using the links below!

Thank you for reading! See you next week and stay safe!

Regards,

Dividend Dollars