Dear DividendDollars community,

As I write this blog post, I am filled with a mix of emotions – gratitude for the journey we’ve shared, pride for the things I’ve learned, a tinge of uncertainty for where I go next, and an ounce of regret for how I started.

DividendDollars began as a passion project in 2021 when I was 23. I wanted it to be a platform to chronicle my journey into fundamental investing in dividend growth companies so that one day, if I became rich and successful, this project would serve as a historical ledger for how it was achieved with the hope that it could help others to do the same. And what a journey it has been!

Over the past three years, I poured my heart, soul, and a ridiculous amount of free time into DividendDollars, diligently writing multiple articles a week, researching stocks, building screeners and tools, contributing to communities and projects, reading every investing book I can get my hands on, and meticulously managing my portfolio. Each article was crafted with care, from the weekly portfolio updates to the market analysis and stock pitches. What a privilege it was to share my thoughts with you here.

Together, we celebrated successes and navigated a difficult market. Our portfolio won with sound investment principles. I’m proud to say that we beat the S&P 500 by 0.62% (as of 3/11/2024) for nearly 3 years. Our portfolio, which started from a humble $0, grew to just under $25,000. Among our victories to produce these results were solid companies like Microsoft, Intel, LPL Financial, NAPCO, and a fun arbitrage play in Activision. However, we weren’t without our issues such as poor investment decisions with $T and $O.

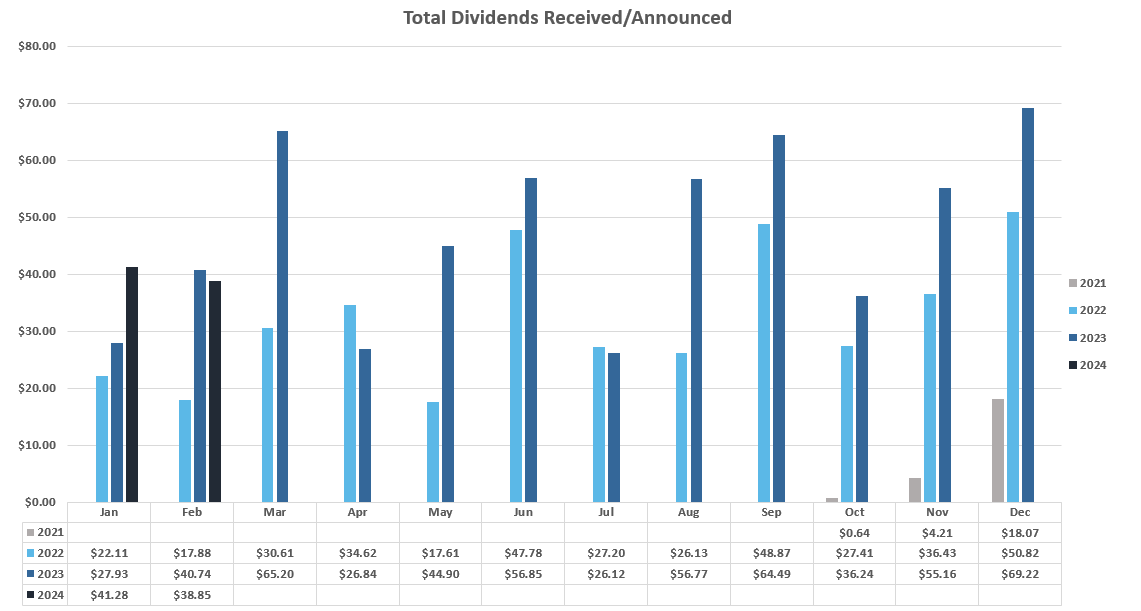

In total, our portfolio earned over $3,300 worth of gains and collected almost $1,400 in dividends and captured premium. These numbers speak volumes about the effectiveness of the approach that we took and the things that we learned.

But amidst all this progress, there is a nagging truth that despite my best efforts, the returns have fallen short of expectations and haven’t justified the effort. While I marginally outperformed the market (which is no small feat for almost 3 years) and experienced modest growth, I can’t shake the feeling that the juice hasn’t been worth the squeeze so far.

Fundamental investing with a long-term mindset is, in my opinion, one of the best investing methods out there. But practicing this with a small portfolio like ours and investing this conservatively at my age hurts my long term prospects and puts the compounding ramp up of returns too far out for my taste.

Through years of learning and reflection, I’ve also come to see that though fundamental investing is a proven and solid path to generating long-term wealth, it is not without its limitations. The unpredictability of macroeconomic events, market sentiment, valuation discrepancies, and other things out of our control can derail even the most perfectly researched investment thesis. And these are just a few examples, I could write a multiple-paged article about this and not even scratch the surface.

Thinking about these things has left me yearning for a more expedited route to financial independence. What good is investing this way if it will only help me retire a mere 5 years earlier? It sounds selfish, but my sights are aimed higher, for my own benefit and the benefit of those I love around me.

Therefore, I find myself on the brink of a new chapter – a departure from DividendDollars and a pivot towards exploring alternative strategies that better align with my aspirations and risk tolerance. As of 3/11/24, I liquidated all of my positions so that I can now pursue this. These are strategies that I must explore and refine on my own terms, away from the public podium so that I can’t lead others astray with me if I fail. This is a decision routed in a desire for greater autonomy and a willingness to embrace a calculated risk that otherwise shouldn’t be applied to everyone.

Though the decision to step away from DividendDollars weighs heavy on my heart, it’s a necessary step towards personal growth and independence. I’m eternally grateful for the thousands of readers and visitors I have had here over the years. I will always carry with me the lessons I’ve learned and will likely return to them at a point in my life that is more appropriate for the DividendDollars financial mindset.

While this door closes, another opens and I am thrilled to step through it. Thank you for being a part of my journey to this point. This website will stay live for a few more months, so please browse and save anything that may be of use to you. Stay following my twitter account as I will still be active in Fintwit, I just won’t be sharing my trades or ideas. One day though, I hope to have a strategy nailed down with results I am proud of and this will be something I share.

So that is all for now.

Regards,

Tanner aka DividendDollars