This weekly market recap is brought to you by Koyfin, a powerful analytical tool that I am proud to partner with. Their platform is entirely customizable for whatever data you want to look at including stocks, ETFs, mutual funds, currencies, economic data releases (one of my personal favorites used often for these posts), crypto, and even transcripts of company events! Click the link above to get a special offer only for Dividend Dollar readers or go give my product review a read if you’re interested!

Dividend Dollars’ Outlook & Opinion

Last week we called for more bullishness, under the caveat that CPI and the Fed do what we expect. And they did not disappoint. I wanted to see the S&P 500 close above 4,340 and it did by a fair margin. Funny enough, Monday’s high touched my level and then gapped well above it at the open on Tuesday. It came back down to test it on Wednesday and it proved to be a solid support line.

Despite Friday’s choppiness, this was one of the best weeks for the market in some time. 52 week highs were being handed out like goodie bags at an Oprah show with $AAPL, $AI, $DAL, $META, $NFLX, $WMT, $UBER, $NVDA, $MSFT, $ORCL, and many others hitting yearly highs.

The hawkish language that was dolled out by the FOMC on Wednesday didn’t seem to scare investors much. I don’t know if it’s a belief that corporate earnings and the general economy will be able to handle a few more hikes, or if they’re calling the bluff on the Fed’s hawkishness. Only time will tell, but the disbelief was obvious this week. Are stocks suggesting the worst is behind us or are there too many of us with FOMO buying up equities right now?

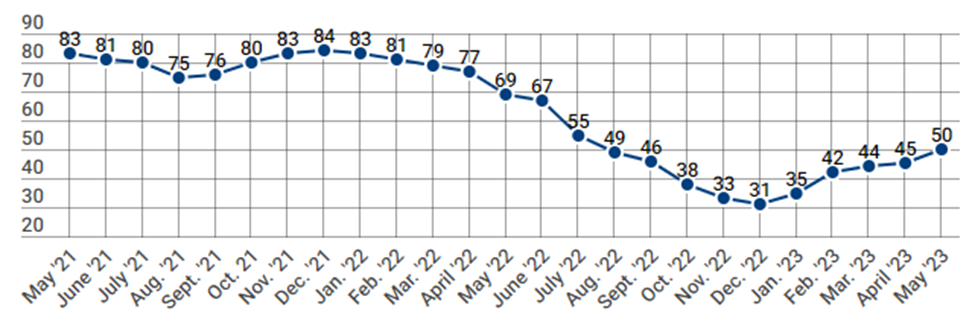

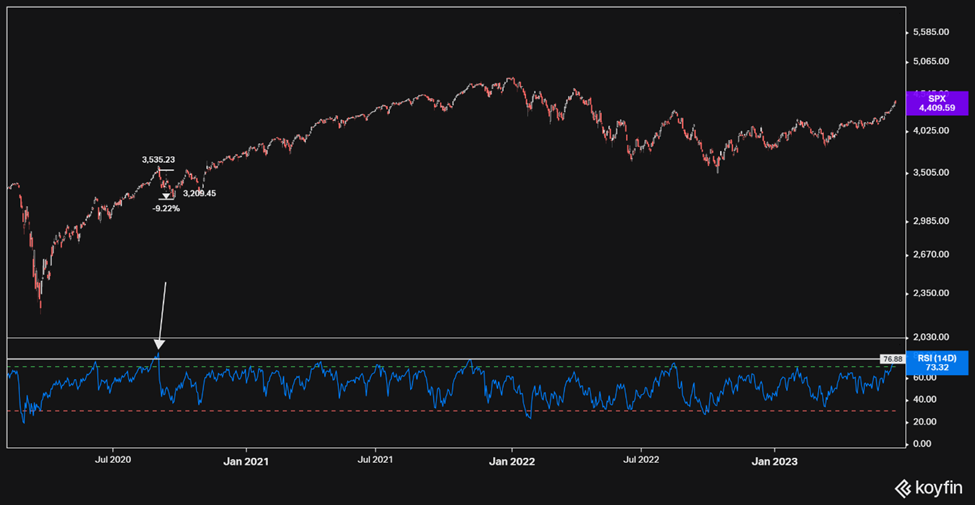

Technical-wise, the S&P 500 is continuing its streak of new 52-week highs as resistance levels seem feeble. After breaking through the firm resistance at 4,200, there has not been much standing in the way of the bulls. However, the market is running very hot with a high RSI reading of just under 77 on Thursday. The last time the RSI read higher than 77 was back in September of 2021 when it hit 82. After that RSI peak, the market experienced a 10% correction over the next three weeks. Could history repeat itself? Usually it does, but the timing is the tricky part. I am loath to call a correction, but I am trying to give you a sense of when one could over the horizon.

However, RSI aside, the chart still looks quite bullish to me. We have a little area of resistance that was generated by some slight consolidation last April, this is noted in the light red channel in the chart below. We absolutely plowed through the 0.618 level (4,312) of the Fibonacci retracement produced from the high of January 2022 to the low of October 2022. This bit of resistance could push us back down to that level or we continue higher to the next level. The market could lose some steam, making a re-test more likely. However, except for Friday, the market’s price action is not exhibiting much weakness!

Overall, this week was heavy with economic data that mostly came in with readings that supported a market move higher. However, in the last hours of the final trading day for the week, some profit taking occurred ahead of the three-day weekend. Inflation has continued to trend down, technicals are still mostly bullish, there is a healthy amount of skepticism among investors, stocks are fully valued at a forward P/E of 19 for the S&P 500, recession risk is not out of the question yet, and we appear to be nearing a reasonable consolidation period. Lots of things to consider. Its hard to time an expected consolidation move, but one seems increasingly possible. On the other hand, I still respect the bullish momentum we’ve been seeing, even though they are starting to appear stretched. Therefore, my outlook for next week is neutral. I equally could see a move higher to the next fib level just above 4,500 or a move to test the 4,300 area. Next week is light on the economic data front as long as we don’t get a jobless claims surprise. So be ready to play either side.

Weekly Market Review

Summary:

This week another bullish one for the market as the major indices hit gains. The S&P 500 had its 5th winning week in a row and closed above 4,400. Mega-caps were leading as $AAPL and $MSFT hit new all time highs. Small and mid-caps trailed them after a big run recently. The Russell 2000 had the smallest gain among the indices for the week but shows the largest gain on the month so far.

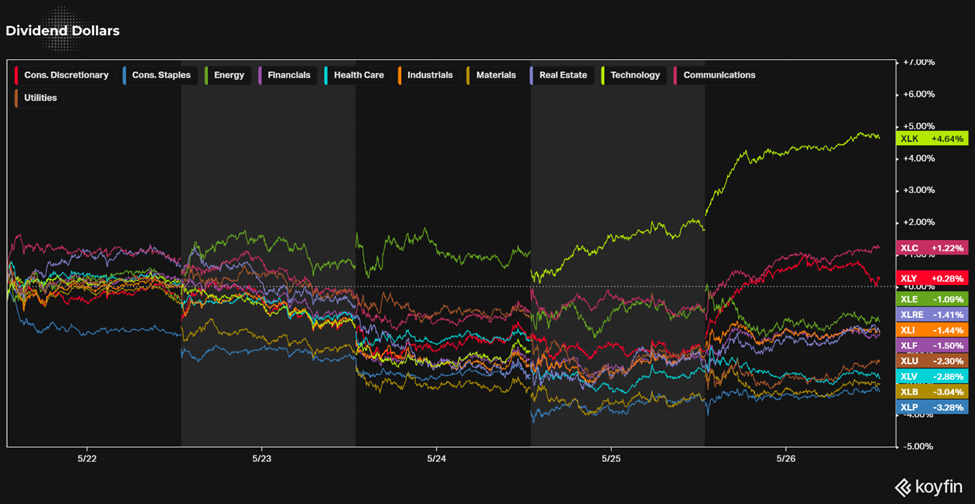

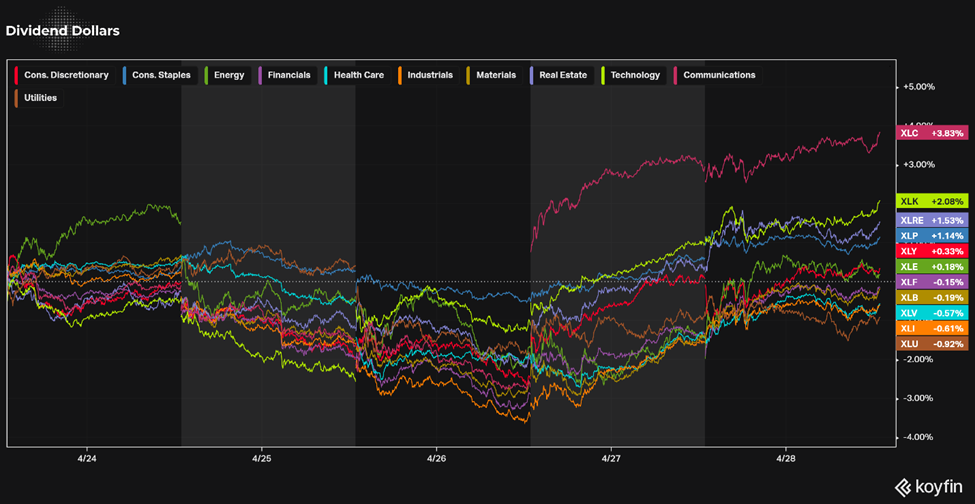

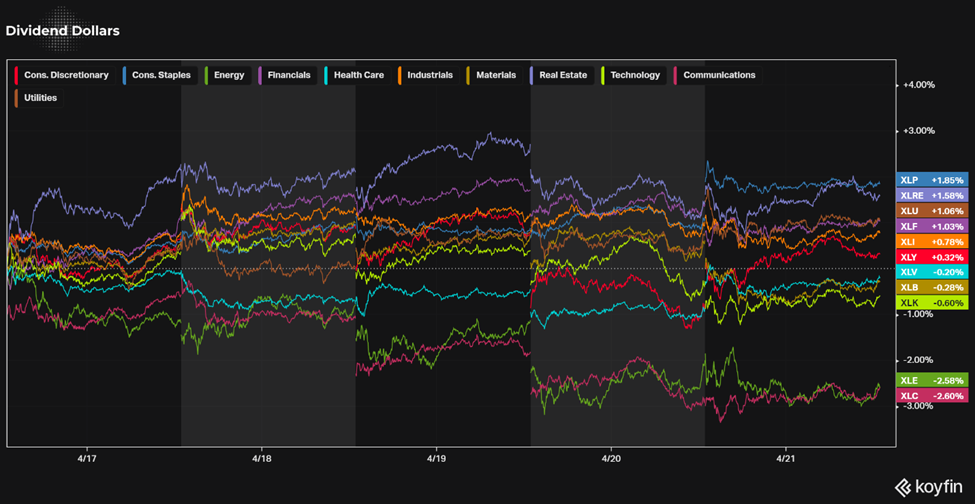

This improvement in market breadth saw the $RSP rise 2.5%. Also, all but 1 of the 11 S&P 5000 sectors made gains this week. Energy was the lone loser (-0.6%) while technology (+4.3%) and materials (+3.5%) lead.

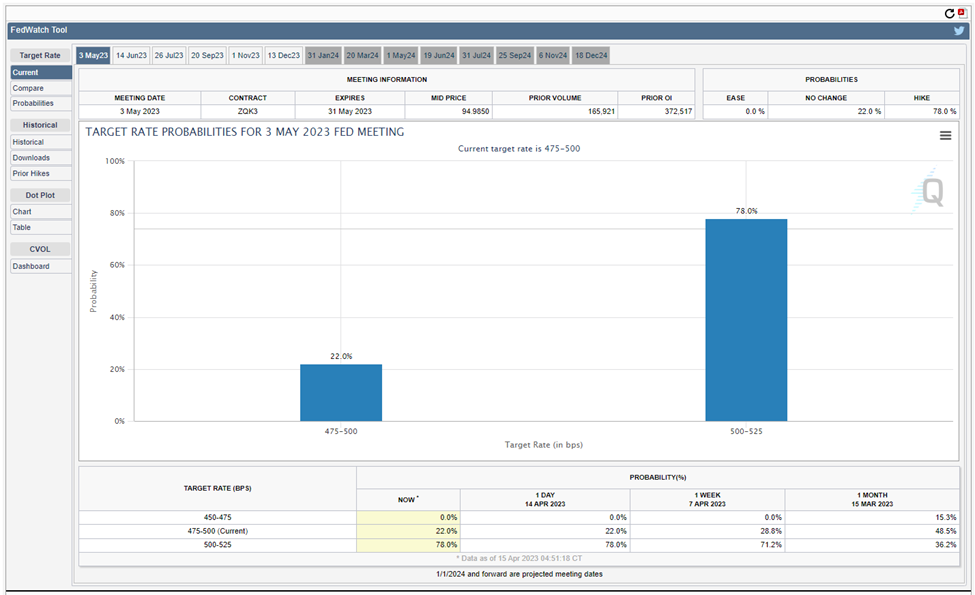

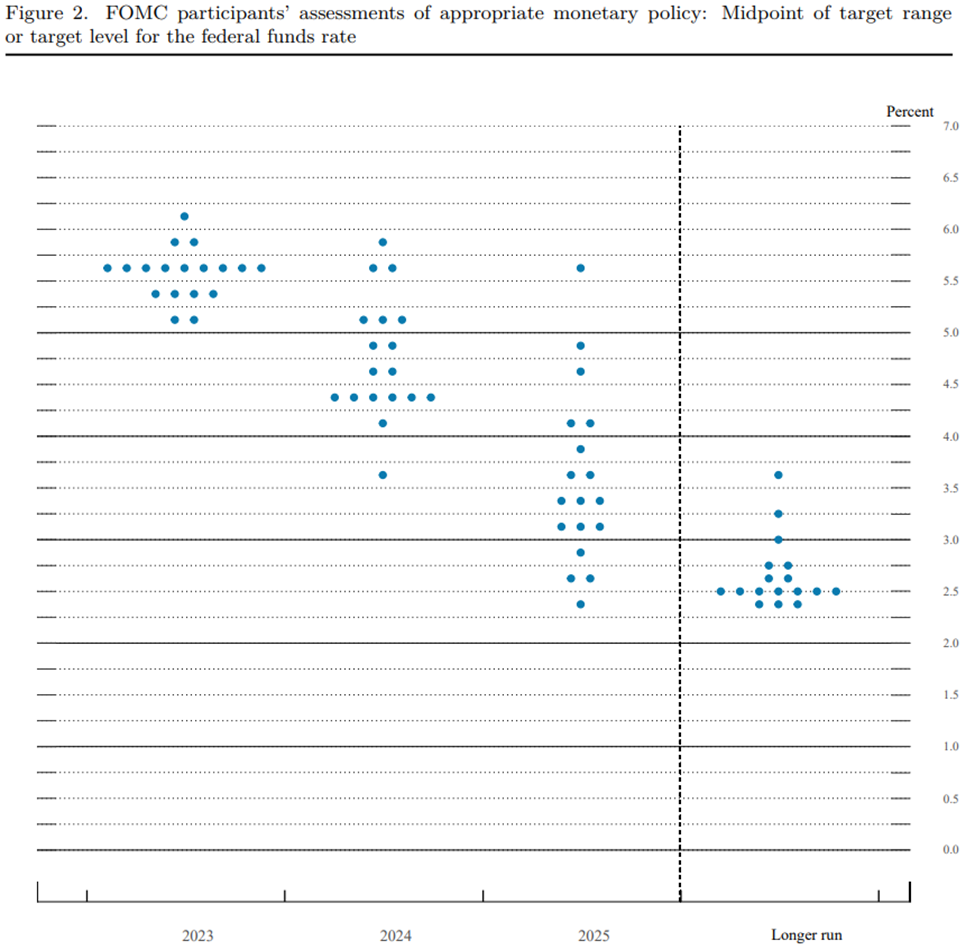

The rally for the week picked up steam as the CPI release on Tuesday, the PPI on Wednesday, and the FOMC meeting all went the market’s way in feeling better about inflation and the economy. The FOMC voted to not change the fed funds rate. The latest dot-plot shows an increase in the median projection for the rate in 2023, meaning there may be at least two more hikes this year. The forecasts for 2024 and 2025 also saw an increase, meaning we have a higher for longer policy rate outlook.

After the minutes release, Fed Powell’s press conference made no promises for the July meeting. In spite of the hawkishness of the Fed materials, the market’s response reflects a belief that the Fed may actually pull off a soft landing and get inflation back down to 2% without too much damage. The market seemed to believe that the Fed may be done, or close to done, with raising rates.

Monday:

Monday looked positive in the beginning of the day, but really started to pick up steam in the afternoon as the S&P closed at its highest level since April 2022. The stock market kicked it into gear as rates declined after the Treasury market did a good job of absorbing the $200B worth of bills and notes, with another $101B scheduled to be sold on Tuesday.

Mega-caps lead the way with many others following as $MGK was up 1.5% and $RSP was up 0.7%. The energy sector, however, failed to perform with its -1% loss. Oil prices fell -4.6% in response to Goldman Sachs cutting its Brent Crude forecast by nearly 10%, citing higher oil supplies.

Tuesday:

Tuesday’s market continued the positivity as indices closed near their best levels of the day. The CPI report released in the morning seemed to enhance the view that the Fed will not raise rates this week and lessened expectations of a hike in July.

Again, price action seemed to show a belief that the Fed may not overtighten on their path to bring inflation back down. That belief was reflected in a more pro-cyclical trade and led to a better performance in domestic small caps and value stocks than growth stocks for the day.

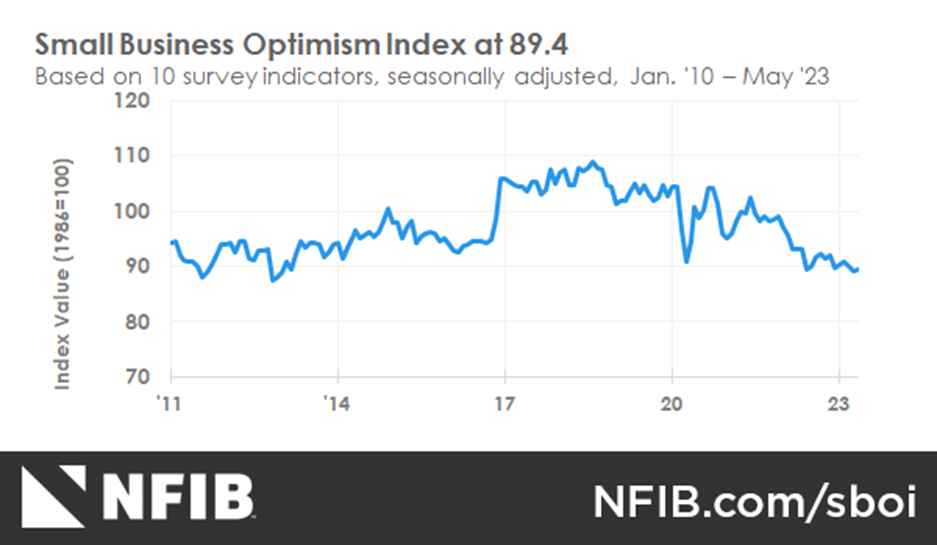

Economic data for the day included the NFIB Small Business Optimism Survey and the CPI report.

The NFIB survey rose to 89.4 up from 89.0 in April. This reading was the 17th consecutive reading below the 49-year average of 98. The survey showed that the difficulty to fill jobs is still historically high, business owners are slightly slowing with raising prices, and sales increase expectations have fallen slightly.

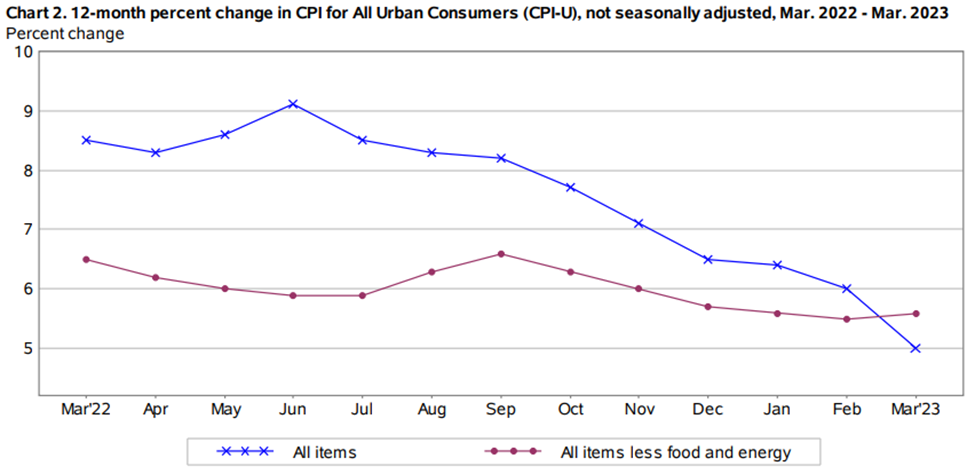

The CPI report was up 0.1% MoM, just under expectations of 0.2%. Core CPI was up 0.4% MoM, as expected. It was driven by an increase in the shelter index and the vehicle index. On a YoY basis, the CPI is up 4% versus 4.9% in April, the smallest change in the 12 months ending March 2021. The Core CPI rose 5.3% YoY, down from 5.5% last reading. The shelter index accounted for over 60% of the total increase. The key takeaway here is that inflation rates are moving in the right direction, but core inflation is still too high for the Fed’s liking which is why future rate hike prospects are still alive.

Wednesday:

The market was in a narrow range, leading up to the FOMC decision in the afternoon and the press conference that followed. They voted unanimously to keep rates, yest stocks fell a bit with the release of their projections which showed an upward adjustment in the median rate for 2023.

The market started to climb as the press conference began. Stocks recovered as Powell said the July meeting is a “live” meeting, meaning its outcome is not predetermined. There are 4 Fed meetings left, and no rate hikes are being frontloaded. The market is making some allowance for the chance that they don’t push the rate as high as the dot plot suggests.

Economic data for the day included the weekly MBA index and the PPI.

The mortgage applications index rose 7.2% with purchase applications jumping up 8% and refinancing up 6%.

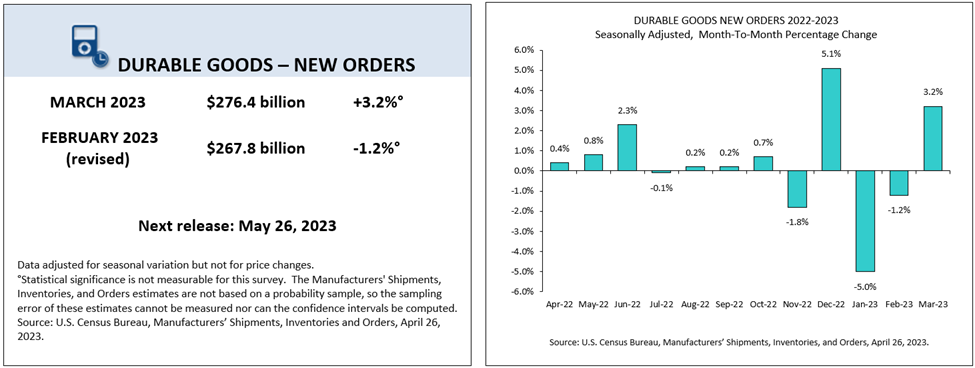

The Producer Price Index reading for final demand fell 0.3% MoM, under the -0.1% consensus, while the core PPI rose 0.2% MoM as expected. YoY the index was up 1.1% versus 2.3% last month, and the core was up 2.8% versus 3.2% last month. The key here is that wholesale inflation is trending in the right direction, which should help with decreasing future rate hike probabilities and positivity for corporate margins.

Thursday:

Thursday was strong as the market rallied on a spattering of economic data releases. The indices closed near their highs of the day.

The economic data was mixed overall, but some highlights fueled the run of the day. $CAVA’s IPO also helped to boost investor sentiment after it opened at a huge premium above is $22 IPO price.

Economic data for the day included retail sales, jobless claims, the May import and export prices, and industrial production.

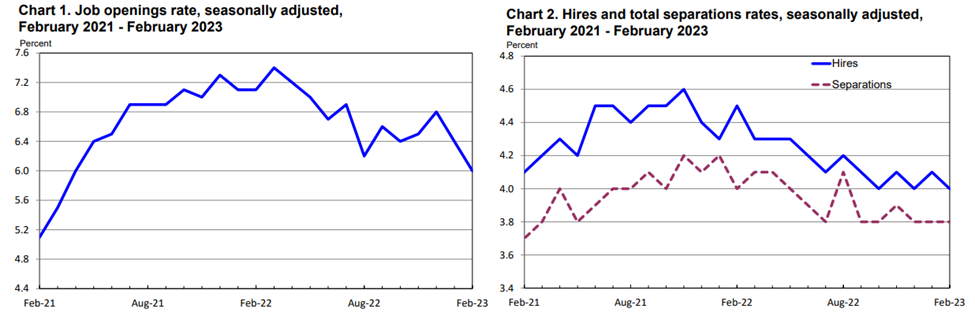

Total retail sales increased 0.3% MoM, above flat expectations. Spending was flat or higher in May for nearly every category with the exception of gasoline stations and miscellaneous retailers, which shows the resilient spending capacity of consumers who continue to benefit from a strong labor market.

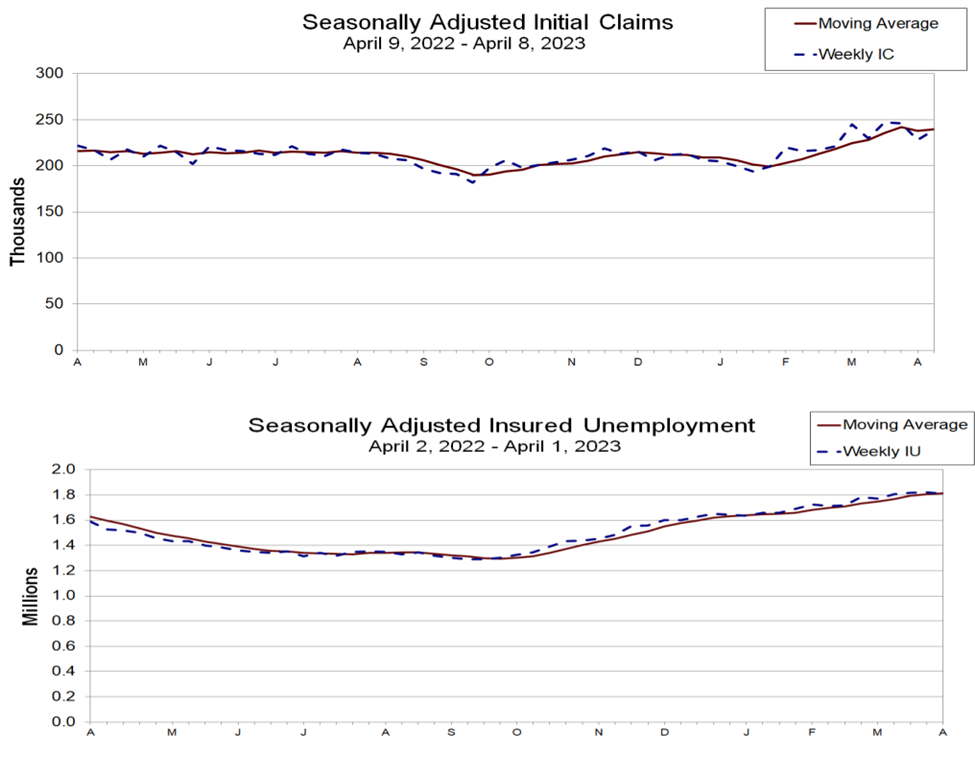

Initial jobless claims were flat at 262k, but above the expected 251k. Continuing claims increased by 20k to 1.775M. Even though these unemployment levels have been higher in recent weeks, they still are well below levels seen in all recessions of the past 4 decades that saw levels read higher than 350k.

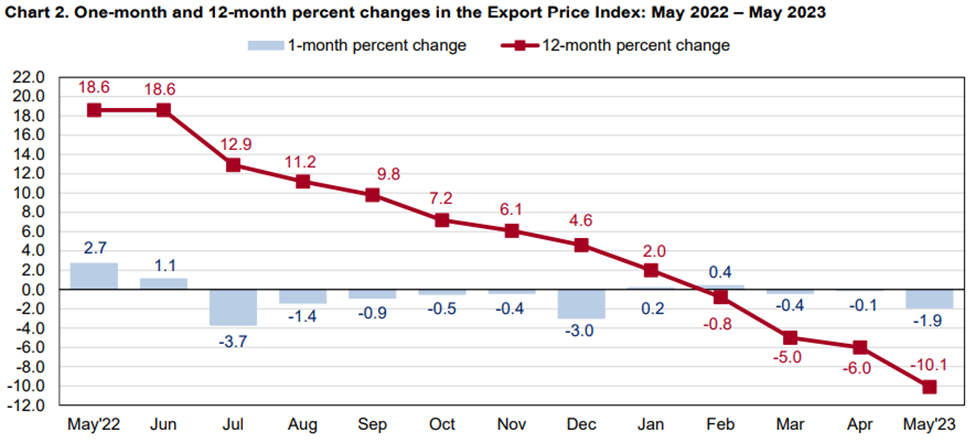

May import prices fell 0.6% MoM after a 0.3% increase in April. Excluding fuel, import prices were down 0.1%. Export prices fell 1.9% MoM after a 0.1% decrease in April. Excluding agriculture products, export prices fell 1.8%. Deflation can be seen in the import prices as they are down 5.9% YoY, nonfuel import prices down 1.9% YoY, export prices down 10.1% YoY, and non-agricultural products down 10.5% YoY.

Total industrial production fell 0.2% MoM, falling short of a +0.1% expectation. The capacity utilization rate fell to 79.6% from 79.8% reading in April. The report shows that manufacturing output is still positive, helping to mitigate weakness in mining and utilities output.

Friday:

The market closed out this quad witching day on a lackluster note, with major indices making moderate losses and spending most of the session near their flat lines. Mega-caps pulled down the indices with their outsized losses.

Pleasing earnings and guidance from $ADBE and Morgan Stanley calling $NVDA its top AI pick with a raised price target continued to drive the AI fever. The fever was not enough to offset the underlying weakness in the market for the day though.

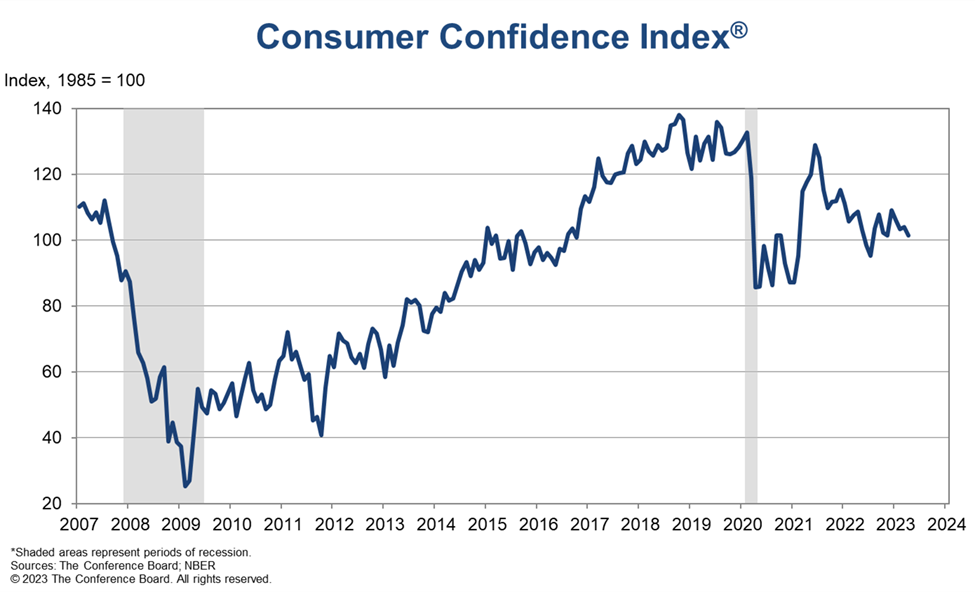

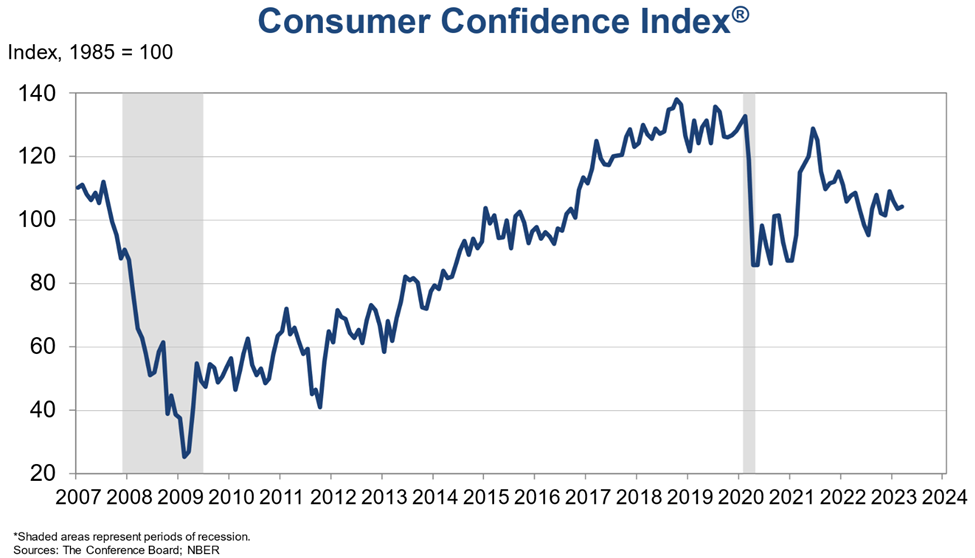

Economic data for the day was only the Consumer Sentiment Index. It came in at 63.9, above a 60.2 expectation and its 59.2 prior reading. A year ago today, the index was at 50.0. The report shows an easing inflation expectation underpinned by consumer sentiment, however, the report notes that many consumers still expect difficult economic times over the next year.

That’s it for my recap! If you would like to see how I am building my dividend portfolio using my predictions/strategy written here, you can read about my buys in my weekly portfolio update on this link.

And if you like updates like this, follow my Twitter or my CommonStock page where I post updates on the economic data throughout the week.

Have a happy Father’s Day and enjoy your three day weekend!

Regards,

Dividend Dollars