Welcome back to Dividend Dollars and our weekly review! And boy what a week it was! We made some adjustments to our energy holdings and crossed our first $100 in dividends!

We lost a day of trading this week due to Good Friday. Having the day off was a good ending to a bad week! The S&P lost 2.1%, Nasdaq 2.6%, the Dow was down 0.8%, with Russell making the only gain of 0.5%.

The information technology, health care, financials, and communication services sectors were the S&P’s biggest losers. Downward movement in the information technology and communication sectors were linked to moves in the Treasury market. The 10-year yield went up 12 basis points this week despite economic discussion that inflation was peaking. That discussion was followed by two days of declining rates following big CPI and PPI numbers for March.

The financial sector was down particularly because of earnings missed by JPM and WFC. Other banks for the most part surpassed expectations.

Airline stocks showed strength this week with AAL raising their Q1 revenue guidance and DAL with earnings that beat expectations. JETS also went up 8% this week.

Aside from airlines doing well, the materials, industrials, energy, and consumer staples sectors of the S&P were positive with gains all under 1%.

Now let’s move on to reviewing our portfolio’s performance for the week.

Portfolio Value

To date, I have invested $8,020 into the account, the total value of all positions plus any cash on hand is $8,494.4. That’s a gain of $474.42 for a total return of 5.92%. The account is down $48.08 for the week which is a 0.56% loss.

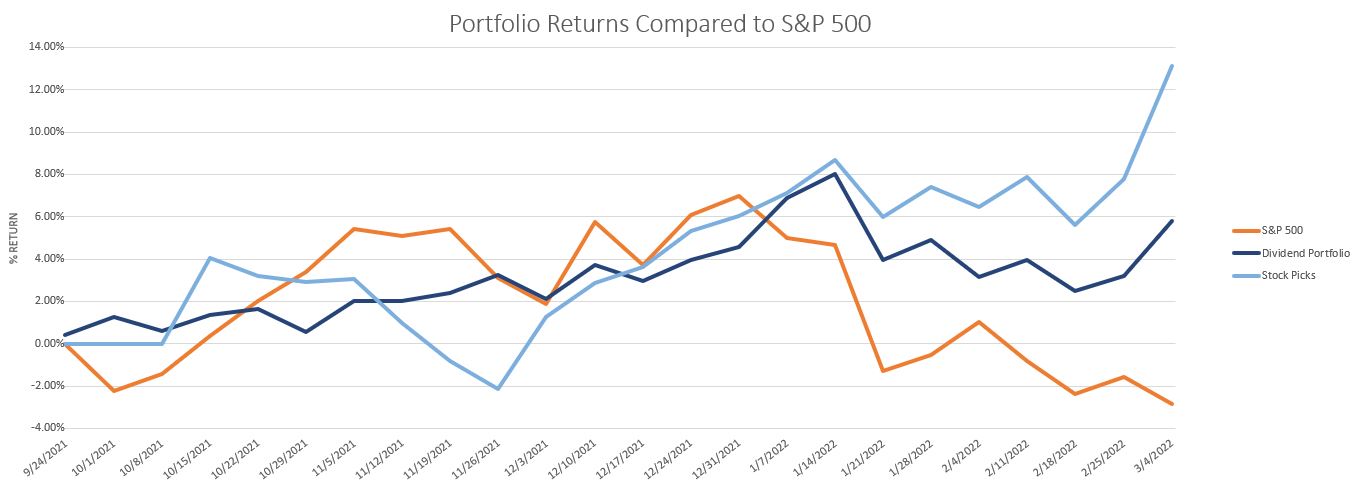

We started building this portfolio on 9/24/2021 and when compared to the S&P 500 we are outperforming the market so far! Within that same timeframe, the S&P 500 is down -1.41% whereas our portfolio has an overall return of 5.92%! Let’s keep up this good progress with smart adds to the portfolio.

We added $120 in cash to the account this week. The stock purchases made with this will be broken out below.

Portfolio

Above is a dashboard of the portfolio that tracks annual dividend income, yield, beta, dividend growth, and more.

Below is a table of everything we are invested in so far. There you can see my number of shares, shares bought through dividend reinvestments, average cost, gains, and more. The tickers in green are positions that I bought shares in this week.

This week our annual dividend income increased by $20. My portfolio’s dividend yield may be just slightly higher than what you will see in other portfolios, however that is strategic per my time horizon. I am in my 20s and am just starting off this investment journey, so a higher dividend yield gives me greater cash flow now to reinvest which helps me realize the benefits of compounding sooner.

Our beta usually hovers right around the mid 0.6s which is good, especially in times of uneasiness. It means my portfolio won’t dip as much as the rest of the market on red days, however, it does go the other way around and I won’t have as much green on the good days. Therefore, it is good to watch your beta in terms of cyclicity. View the chart above to see the performance of my portfolio versus the S&P 500, notice how my portfolio’s green days are not as substantial as the S&P’s but neither are my red days, that is beta at work. My beta so far has led to better returns than the market since beginning this portfolio, however, on rally weeks I underperform. In order to combat that, I have started adding to a levered position to raise my beta. I would like to see it in the 0.8s.

Dividends

This week we received two dividends. $13.77 from UWMC and $3.17 from BBY

In my portfolio, all positions have dividend reinvestment enabled. I don’t hold onto the dividend, I don’t try to time the reinvestment, I just let my broker do it automatically. All dividends were reinvested (except for BBY, that will be reinvested on Monday).

Dividends received for 2022: $90.19

Portfolio’s Lifetime Dividends: $113.11

Trades

Below is a breakdown of my trades this week.

On Wednesday I did some restructuring of the portfolio. I sold my whole position in EOG and spun a majority of those into a new utilities position in AY. There are a couple of reasons I did this. The IPCC report came out this week and is pretty grim about the future of our planet. It makes it clear that the devastating impacts of a climate crisis are occurring and the opportunity to curb terrible outcomes are already slipping through our fingers. The report says that greenhouse gas emissions must peak by 2025 to limit global warming close to 1.5 degrees Celsius as targeted by the Paris Agreement. Mitigating climate change continues to a growing and ever important focus for governments, business, and people.

Though the Ukraine conflict is where the world’s attention is at right now. I still believe that oil will be a good business model in the short term, thus I am continuing to hold CVX, but I believe that adoption of more “green” policies are inevitable and will come sooner or later. When this happens, oil companies will come under pressure and renewable energy companies will benefit. It will be a long transition, possibly over decades. But I would rather build positions on renewable energy companies now instead of later. For that reason, I sold my EOG position and rolled it into a new position in AY, a sustainable infrastructure company with a majority of its business in renewable energy assets (solar, water, and wind).

- April 11th

- T – added 2 shares at 19.59

- SMHB – added 1 share at $10.99

- UWMC – added 3.251476 shares through $13.77 dividend reinvested

- April 12th

- UWMC – added 3 shares at $3.97

- MMM – added 0.1 shares at $148.70

- April 13th

- EOG – sold position (3.113613 shares) for a 45% gain

- AY – new position, bought 6 shares at $33.56

- BAC – added 2 shares at $38.86

- T – added 5 shares at $19.44

- SCHD – added 0.126727 shares at $78.91 (recurring investment)

- XYLD – added 0.201191 shares at $49.70 (recurring investment)

- April 14th

- SBUX – added 0.25 shares at $79.68

- UWMC – added 3 shares at $3.90

- SMHB – added 1 share at $10.94

Summary

That is it for the update this week. Let’s kill it next week. Stay patient and be ready to buy income producing assets at a discount!

Let me know what you think of the progress so far, share with me your progress and questions, interact with me on twitter and Instagram using the links below!

Thank you for reading! See you next week and have a happy and safe Easter!