3M…this powerhouse of a company may not immediately be recognizable by most eyes, but when you start to look, you will see their logo everywhere. They are the manufacturer of many well-known brands such as Post-Its, Nexcare Band-Aids, ScotchTape, Filtrete, Command strips, and many more. They’ve paid uninterrupted dividends for over 100 years and have increased their dividend 63 years in a row. And yet, their stock price has dropped over 20% in the last year.

This company is a staunch representation of a tried and true business. They have survived the Great Depression of the 1930’s, they made it through the Great Recession in the 2000s, but can they now persevere through a shifting economy and the multi-billion dollar headwinds that face them currently as a much older, larger, and less nimble conglomerate?

Spoiler alert: I believe they can, and I also believe these headwinds are currently presenting investors with an amazing opportunity to build an extremely strong position in a very promising dividend king.

In this deep dive we will discuss 3M as whole, analyzing everything from their financials, product portfolio, competitive advantages, bearish litigations, dividend history, valuation, company outlook, risk, analyst consensus, and more. All so we can get the big picture and decide for if this is a good fit for your portfolio or a good time to add.

Without further ado, let’s jump in!

Business Overview

3M is a multinational industrial conglomerate that has operated since 1902 when it was known as Minnesota Mining and Manufacturing. They are well-known for their research and development laboratory which they use to leverage their science and technology across their vast line of product offerings.

As of 2020, 3M has four business segments: safety and industrial, healthcare, transportation and electronics, and consumer. Nearly half of the company’s revenue comes from outside the US and most of it comes from their industrial segment. 3M has over 55,000 products which touch every market imaginable and an even larger portfolio of patents. 3M manages a sticky product line that affords them pricing power while also retaining customer loyalty and market share where it competes.

Business Strategy

3M, at its core, is a materials science company. Their huge mob of engineers break everyday products down to their levels of basic chemistry in order to improve them.

For example, 3M’s Smog-reducing Granules were created in 2018 and were adapted and applied to roofing shingles to combat air pollution. The granules have a photocatalytic coating that 3M applies to the base mineral of the shingles so that when sunlight hits it, UV rays from the sun transform pollutants into a plant-usable form of nitrogen that washes away with rain or a quick rinse with the hose. Each ton of these shingles have the capacity to capture the smog created by a car that drives 3,000 miles a year.

Another example is their microreplication technology which has been around since the 60’s. It was originally used in overhead projectors but has now been adapted for multiple use-cases including brighter signs and reflectors, reduced friction for aerospace applications, and most recently as an alternative method for vaccine delivery.

3M holds onto their proprietary secrets making their technology difficult to imitate. Because of this, many of their products can get away with a 10-30% premium compared to similar products. 3M’s ability to adapt their technologies into multiple use cases increases the scope of their products which in turn reduces overall unit cost by quickening their progression through the manufacturing learning curve of the products and thus the realization of their margins.

3M develops their technologies internally and also (recently I might add) started to acquire smaller businesses to bring their technologies into their larger product portfolio. Acquiring these companies allows their products and technologies to progress quicker than if they had remained independent. 3M’s recent acquisitions in wound-care solutions provider Acelity and workflow solutions provider MModal will allow them to capitalize on the stable and growing healthcare market and push these companies to success that they most likely could not have reached on their own.

Despite pandemic-related and litigation-related headwinds, I believe that 3M is well positioned in a number of high growth markets that will allow them to grow their intrinsic value over the long term.

Competitive Advantages

We already touched on one of their advantages (cost advantage due to economies of scope and scale) in the prior section. The other advantage they have is in their intangible assets.

3M is a champion of innovation (my university would be proud (if you get this joke just know that you’re awesome)). Their Research and Development is arguably their core competence and they lean on it heavily. They leverage their R&D across all their products, and this has created many successful patents, proprietary technology, and brands.

About 6% of 3M’s sales is spent on R&D. Per the S&P 500, companies within the materials and industrials sectors spent 1.4% and 0.7%, respectively. 3M invests hard into their innovations and they earn a strong yield from these investments. Of the Top 10 Most Innovative Companies of 2021 as named by the Boston Consulting Group, 3M’s return on research capital was 8.82 and was only beat by TSLA. The rest of the group averaged a return of around 5.5. View the graphic below. This means that for every dollar spent on R&D in 2020, 3M yielded $8.82 in gross profits.

This is a testament to 3M’s business model which emphasizes effective commercialization of their R&D. 3M allots 15% of senior engineers’ time to unbudgeted work on any new ideas separate from their individual work responsibilities. 3M’s experience with R&D allows them the added benefit of knowing when to cut programs early when they know it won’t be profitable and speeding up programs when they will be. With over 55,000 products in their portfolio, 3M is not over-weighted in any individual asset which increases my confidence in its long term returns on research capital.

This emphasis on R&D creates better products. Better products mean 3M can charge a premium. And they do! Post-It notes typically sell at 30% premium over store brand alternatives. This is a steep premium, but consumers are willing to pay it due to the superior quality. This quality has caused 3M to grow in brand value in recent years, climbing from the 90th spot in Interbrand’s top 100 Best Global Brands in 2010 to the 67th spot in 2021, ahead of well-known brands like FedEx and Zoom.

This R&D also has the benefit of awarding many patents to 3M. Since 2001, the firm has been awarded over 9,000 US patents and has been awarded over 118,000 global patents throughout its history. The value of these patents are held within the firms Intangible Asset value of $5.2 billion from their 2021 balance sheet.

Managing this huge portfolio of products would be quite the undertaking for most companies. 3M manages it by regionalizing their supply chains to reduce the complexity and length of the manufacturing process. This translates to a decreased need for working capital and better capital efficiency, thus driving down unit costs, boosting gross margins (46.8% for 2021), and improving customer experience with fewer back orders. 3M also employs an ERP program which further enhances the functions of their supply chains and customer service.

On the topic of supply chains, much of 3M’s is vertically integrated. This further enhances their economies of scale and insulates them from localized supply chain issues. 3M has 200 plants around the world, most of which are, on average, larger and more productive than typical plants. This is true of their distribution centers as well.

Financials

For the income statement, 3M’s revenues have grown from $29.9 Billion in 2012 to $35.4 Billion in 2021. Revenues for 2021 were very strong, showing an increase of 9.8% on the prior year. The compound annual growth rate of revenues for the last 10 years is 1.69. Gross margins have averaged 48% through this time frame with 2021’s margins falling just short at 47%.

Over this 10-year period, revenues have grown by 16% and operating income has grown by 18%. This is particularly important because R&D is a substantial expense that lowers operating income. Over this 10-year period, 3M has increased R&D spending by 22% and yet, operating income was still able to grow by 18%, meaning other SG&A expenses are shrinking to keep operating income growing. This is great balance sheet management.

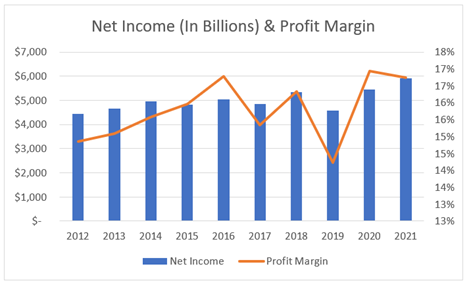

For the last 10 years, net income has grown from $4.4 billion to $5.9 billion and net profit margins have grown from 14.9% to 16.7%. This yields a CAGR of 2.91%. 3M is doing very well considering that all of the companies in the S&P 500 averaged a margin of 14.3% from 2001 to 2020.

For the balance sheet, 3M has grown total assets from $33.9 billion in 2012 to $47.1 billion in 2021, a $13.2 billion increase. Within the last 3 years, goodwill in the balance sheet has increased substantially because of the MModal and Acelity acquisitions.

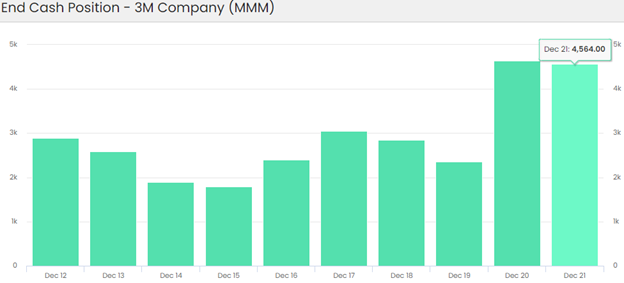

At the same time total debt has grown from $6.1 billion to $18.3 billion, a $12.2 billion increase. Though I don’t like seeing debt grow this much, it is still smaller than the increase seen in total assets which is good. What’s even better is that after all investing and financing activities, 3M had an ending cash position of $4.6 billion in 2021. This tells me that 3M brings in and holds onto enough cash to finance any debt activities and still has enough money at the end of the day to pay dividends. Their debt to EBITDA, interest coverage, and free cash flow levels further support this.

The Bad News

On February 14th, 2022, 3M provided a financial guidance and strategic update for 2022. The presentation touched on a lot of things but managed to avoid addressing most investors’ concerns about the legal liabilities that currently surround the company.

3M currently has two legal headwinds. One is in regard to the company’s legacy PFAS chemicals and the other is concerning their military earplugs. The company’s military earplugs liability looks to be the larger of the two.

In 2008, 3M acquired a business that sold government-approved combat earplugs called Combat Arms Earplugs Version 2 (CAEv2) from 2003 till its discontinuation in 2015. The earplugs were widely used in Afghanistan and Iraq during that timeframe. More than 2 million servicemembers were deployed during that time.

The first lawsuit popped up in 2018 when a veteran claimed he had received hearing damage during his time serving because of the faulty earplugs. By the end of 2021, 3M had been received lawsuits representing over 13,000 claimants with similar allegations. Additionally, 290,000 unfiled claims have been maintained in the court, making this issue the largest multidistrict litigation (MDL) since the system was made in 1968. Some of these claims are likely to be dismissed, but the total legal liability is still huge here.

It is not yet clear whether the sheer size of this MDL will work in favor of 3M’s side or the other. Defendants have preferred MDLs as a way of taking care of a large number of cases by winning favorable pre-trial rulings, but the public attention surrounding this MDL could change that approach.

In 2018, 3M paid $9.1 million to settle claims by the US government that they concealed the plug’s defects but did not admit liability.

Hearing damage is the leading cause of disability reported to the VA. Different kinds of hearing damage get different settlement amounts. The average verdict of partial hearing loss is a $139,000 settlement and $14,000 for inner ear dysfunction.

Of the 11 bellwether trials that have taken place so far, 3M has won 6 and has paid combined verdicts of $51.4 million paid to 9 plaintiffs. The twelfth trial is taking place currently and 4 more trials are scheduled to take place before June. 3M plans to appeal adverse verdicts.

The potential for liabilities here is huge, but it is important to remember a few things with MDLs like these: (1) magnitude and validity of these cases are generally stronger at the beginning of this process and (2) settlements are generally paid out across several years.

With that in mind, many analysts say the overall earplug liability could range from $10 to $60 billion. Morningstar Analysts expect a $3 billion liability, but I think this number is very conservative. 3M retains about $2.5 billion of free cash flow every year after paying dividends, if we assume a spread of payments and full usage of this free cash flow, it looks like upwards of $40 billion of legal costs could be managed while also keeping the balance sheet at levels that leaves the dividend unharmed.

3M is going to need to lean on its strong balance sheet to cover these liabilities. They have already shown that they are taking steps to prepare for this. Last month, 3M announced a measly 0.7% increase on its dividend. This keeps their growth streak intact while not significantly dipping into the balance sheet that will be needed to cover these allegations.

Whew that’s a lot of information…but wait there’s more! We still have the PFAS liability to talk about.

3M manufactured Per- and Polyfluoroalkyl Substances (PFAS) from the 1950s through the 2000s. These chemicals used in a variety of their consumer and industrial products like fire-extinguisher foam, food wrapping, and nonstick and water-resistant coatings. These chemicals are quite toxic and have earned the nickname of “forever chemicals” because of the carbon fluorine bonds (one of the strongest bonds in organic chemistry) that the chemicals make use of. Those bonds give the chemicals a very long half-life which extends their persistence, toxicity, and occurrence in the blood of wildlife populations.

3M faces several lawsuits accusing them of polluting water supplies at locations where they had previously manufactured PFAS. Bellwether trials for this litigation are expected to begin in 2023 which is also the timeframe within which the EPA seeks to classify certain PFAS as hazardous substances. We will be waiting for years until the full scope of these liabilities are known.

Some analysts expect total liabilities for the PFAS cases to total around $10 billion with the worst-case scenario estimating $30 billion.

Ironically, despite all of these legal troubles, 3M was named as one of the World’s Most Ethical Companies by Ethisphere for the 9th year in a row on March 15th 2022.

Fair Value

Average analyst consensus on price target (as found on MarketWatch and Wallstreet Journal) predicts upside of 16%. Morningstar’s Analysis predicts 23%. Trefis predicts 27% upside. Most analysts have kept their rating as “hold” for MMM excepting Morgan Stanley who downgraded their rating in February.

The timing and the magnitude of these legal liabilities have a profound effect on the stock price. At the time of writing this, MMM stock price is $147.69. MMM is at a P/E of 14.2 and the industrial sector as a whole has a P/E of 19.0. It has a dividend yield of 4.04% which is 33% greater than their 5-year average. Additionally, MMM is only 4% away from its 52-week low.

All these things show that MMM is trading roughly at a 24% discount compared to the rest of the sector. This discount represents roughly $25 billion of market cap which could be interpreted as the amount of legal liabilities that the market has baked into 3M’s valuation.

3M’s discount appears reasonable based on the information we have today but should expected liabilities increase as we get more information from the bellwether trials, investors need to be ready for more downside. Until these liabilities are resolved, they will continue to be 3M’s headwind. Otherwise, their well-diversified and high-margin product line looks to, at the least, follow global GDP, if not surpassing it.

Let’s Get Technical

MMM’s chart has been in a declining channel (blue lines in the chart) since June of 2021 when it’s price was around $200. Since then, it has fallen to $140 in March of 2022 for a 30% loss. Price action has experienced a bounce off of the $140 level and closed at $149 at the time of writing this article.

That bounce occurred at the bottom of the channel and also at a support level at $140 that formed in March of 2021. Currently, the price action is hitting a resistance level at $150 that formed in September of 2020 and wasn’t previously broken till May of 2021 (grey lines in the chart).

Volume levels for the last two months have been higher than average which is good for price action, however, the MACD does not show signs of reversing (the two rows underneath the chart). The last time the MACD was at these levels was in April of 2020 when we saw the run from $120 up to $210.

Can we expect another run like that to happen soon? I do not believe so. The price of MMM has two tasks ahead of it, it needs to break through that $150 level with enough force to also break through the upper end of the channel before substantial gains on stock price can be realized.

That is how I would treat trading this stock in the short term. However, after having gone over the pending legal challenges the firm faces, I believe it is more likely that price action will stay within the declining channel.

My approach will be to accumulate shares while the price is stuck within this declining channel. This channel gives us a great opportunity to continue adding cheap shares and build up our dividend income which the firm has shown signs of keeping safe from the firm’s current issues.

The Good and The Bad – A Summary

Overall, there’s a lot to digest here. Believe it or not, I didn’t even get to include everything I wanted to in here! But this article presents the base case for MMM, so let’s review the good and the bad and see what we think.

| The Good | The Bad |

| Diverse product portfolio that charges a premium | Though they are still growing, gross profits and R&D spending have started to slow |

| Greater R&D spending and returns than competitors | Recent emphasis on acquisitions is a shift in historical company strategy |

| R&D enables multiple use cases of existing platforms | Earplug liability uncertainty; max liability (extremely liberal estimation) of $60 billion |

| Strong intangible assets via patents | PFAS liability uncertainty; max liability estimated at $10 billion |

| Strong customer relationships supported by +100 years of operations | Slowing COVID sales from respirators and masks |

| Climbing revenues and margins | Mostly negative technical indicators |

| Balance sheet assets growing faster than liabilities | |

| Ability to reposition portfolio towards faster-growing segments | |

| Discounted Dividend King with 100+ years of consecutive payments and 60+ years of consecutive increases |

My opinion of 3M is a bullish one. Yes, the legal liabilities facing the company are huge, but a majority of that cost is already baked into the stock price. Only time will tell, but as these cases progress, I don’t expect to see much more downside per the reasons discussed earlier.

In the meantime, 3M is at a roughly 20% discount and pays a 4% dividend. 3M has shown that they will protect the dividend growth streak through these headwinds. Therefore, as a dividend investor, I see a particularly rare opportunity here to build a substantial position in a market sector leader that is destined to bounce back once these legal headwinds are out the door.

As long as the price of 3M is held down by these legalities and they continue to show signs of protecting the dividend, I will be buying it up and reinvesting these cheap dividends.

Thank you for reading this analysis! Leave a comment or reach out to me on Twitter or CommonStock with any questions or comments you may have!