Welcome to another monthly dividend stock pick post and welcome to the new year! Here I will explain my screening process for finding high-quality dividend stocks and using my charting and company analysis to determine if these stocks are a good buy this month. Please keep in mind, all suggestions or chart interpretations are all my opinion, I always highly advise you do your own research and make sure you understand a company before you invest in it.

Now let’s dive into the stock screening criteria and our picks for this month!

Stock Screening Criteria

My stock screening criteria contains a mix of hard stats combined with a few fundamental ratios that I use as rules of thumb in order to identify stocks that reliably pay increasing dividends while also identifying if the stocks are undervalued and poised for growth.

My criteria gave me a list of 24 stocks which I narrowed down to 3. As Warren Buffett once said, “Never invest in a company you don’t understand.” I adhere to this rule and take stocks out of my watchlist based on my comfortability with understanding the company and the attractiveness of their chart. Below are the criteria and why I use them.

Market Capitalization

Market Capitalization, also called market cap, shows us how much a company is worth as determined by the stock market. A company’s market cap is equal to the total value of a company’s outstanding shares of stock. For example, if a company has a total of 1 million shares selling for $10 each, that company’s market cap would be 10 million.

I screen for companies with a market cap of at least 10 billion. These are generally called large-cap companies. These companies are large, established, are the most common stocks to pay dividends, and are not generally at risk of going under any time soon. For a dividend portfolio, large cap stocks will be our bread and butter. These companies do not usually bring in huge gains in the short term, but in the long term they generally trend upward with consistent increases in share value and dividend payments, which is the name of game with a dividend portfolio.

I will do some experimenting with smaller companies; however, these monthly stock picks will be the majority of my portfolio and thus I will stick to screening for companies with a market cap of at least 10 billion.

Dividend Yield

The dividend yield is a financial ratio which shows how much a company pays out in dividends each year in relation to its stock price (annual dividends per share/price per share). For example, if a stock pays $5 per year and has a market price of $100, the dividend yield would be 5%.

As a dividend investor, you would think that the higher the yield the better because we want to maximize dividends. While that logic is correct, it is important to understand why certain stocks may have uncommonly high dividend yields. If a company has healthy finances, a high dividend yield may mean that the company is unnecessarily shelling out lots of money in the forms of dividends when it could be utilizing some of those funds instead to better position the company for long term success. Every dollar a company pays out as a dividend is a dollar the company is not using to generate capital gains. We want to see a healthy balance of dividends and capital growth and sometimes a high dividend yield indicates the opposite.

A high dividend yield could also mean the stock’s price is declining while the dividend payout remains the same. The stock’s price is the denominator in the equation, so if the stock is trending downwards and the dividend payout remains the same, it will inflate the yield. Take for example a stock that paid a $1 dollar dividend per share last year with a cost of $20 dollars per share. That results in a 5% dividend yield. Imagine this year that same stock still paid $1 but now the stock was worth $10. The dividend yield would now be 10%, which is an increase from last year at the expense of the stock going down 50%.

In summary, a high dividend yield is not always bad, it just calls to our attention that we should review other metrics of the stock to confirm that the company is healthy. With all those things in mind, I screen with a dividend yield of greater than 2%. The average dividend yield of the S&P 500 is 2.22%. This keeps us right at the average. We still may see some suspiciously high yields in our list, this just means we will dive into those stocks in more depth to understand why. We may also see some lower yields, but those low yields should be justified by strong dividend growth. In the long run, a mix of high yield and low yield/high growth dividend stocks will be good for our portfolio.

Consecutive Years of Dividend Growth

This criterion is straight forward. Past performance isn’t always a great indicator of future performance, but in the case of dividends I don’t think this mindset is overly risky. If a dividend has increased year over year for a substantial amount of time, it is fair to expect that it will continue to do so. That is why I screen for stocks that have grown their dividends consecutively for at least 7 years. Lots of companies pride themselves on attaining the status of a “Dividend King” or a “Dividend Aristocrat” as it is quite the impressive title and it attracts dividend investors which is good for the stock’s price in the long term. By screening for at least 7 years of consecutive increases we, at the least, may be able to find companies that are on their way to attaining those titles (if they aren’t achieved already) and we can benefit from their efforts to do so.

P/E Ratio

This criterion I use as a rule of thumb and not a hard stat. P/E ratio is the price-to-earnings ratio and is calculated by market value per share divided by earnings per share. This ratio is commonly used by investors and analysts to determine if a stock is relatively undervalued and overvalued. This is where Warren Buffett found lots of success, he was great at finding companies that had discounted stock prices.

There are many complex methodologies that one can use to determine a stock’s relative value, however I believe the P/E ratio is the quickest and most straightforward way to understand a stock’s relative value. Generally, a high P/E ratio means that a stock is overvalued, and a low ratio means it is undervalued.

Seems simple enough, but there are a few limitations to keep in mind. With earnings per share as the denominator, if a stock has a very small earnings per share or none at all the P/E ratio won’t give you a true understanding of the stock’s relative value. P/E ratios also vary greatly from industry to industry. Therefore, it is helpful to view a stocks P/E ratio year over year to see how it is trending relative to stock price. It is also helpful to understand the P/E ratio of the market or the industry a certain stock is in. This information can give you context clues to determine if a stocks P/E ratio is healthy or not.

The S&P 500 has averaged a P/E ratio of 15.95 since its inception. With the above information in mind, I like to look for P/E ratios that range from 15-30, but sometimes exceptions will be made for stocks that require further research.

D/E Ratio

The debt-to-equity ratio compares a company’s total liabilities to its shareholder equity which lets us know how much leverage they are using. It measures how much debt versus equity they are using to finance their operations. In general, a high D/E ratio means higher leverage which means the company is aggressively financing its growth with debt which is risky.

If a lot of debt is used to finance the business, the cost of that debt could outweigh the benefits of the increase in earnings that it produces, however the opposite can also be true in some cases. Cost of debt can vary with market conditions and D/E ratios can vary greatly depending on industry, so it’s not always clear if a company is over leveraged or not.

In general, a high D/E ratio usually means more risk, especially to stocks that pay dividends. If a company is needing to pay down its debts, it has less cash on hand to pay dividends. My general rule of thumb for D/E trailing 12 month average is less than 15. Best case scenario, the D/E is less than 2, but some stocks will be in industries that are capital intensive which generally require more debt, so I will not immediately remove a stock from this list if they have a high D/E, these stocks will just require further research.

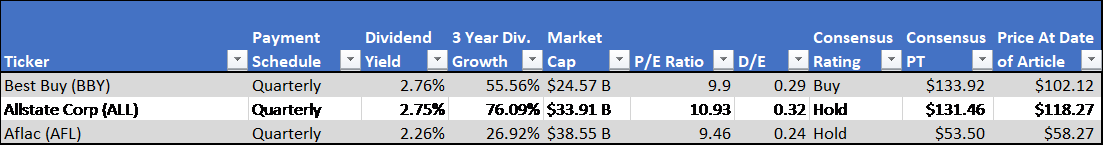

December Picks

Above is a table of the stocks, their data that meets my screening criteria, plus some other information that is beneficial for evaluating dividend strength and good times to buy. Next, we will look at each stock, go over a little bit about the company, and discuss their chart.

Best Buy Co. (BBY)

Best Buy Co. retails technology products in the United States and Canada. They provide computing, mobile phones, and many other consumer electronics and appliances. In addition, Best Buy also provides consultation, delivery, design, installation, memberships, protection plans, repair, set-up, and other technical support services. As of January 30th, 2021, Best Buy had 1,126 large-format at 33 small-format stores. The only concerning thing I saw about was their PE ratio of 9.9. This number is a little bit below my criteria, however, given the industry average of 11.96, their PE ratio is not bad.

Best Buy’s chart looks promising. Within the last month, BBY has bounced for the third time off of the channel support line at the $95 area, with the first bounce happening in December of 2020 and quickly moved up to the $115 area. I would expect a similar move this bounce given the strong RSI and state of the market. If this fails, we could see yet another approach to the $95 area followed by yet another bounce or a break.

Allstate (ALL)

Allstate provides property and casualty, and other insurance products in the United States and Canada. They have a diverse line of products across a wide range of segments. They sell through their call centers, agencies, financial specialists, brokers, wholesale partners, affinity groups, and online and mobile applications. Given the economic uncertainty of 2022, insurance stocks make great picks for this watchlist due to their excellent long-term returns and necessity regardless of economic health. Like Best Buy, Allstate has a lower than desired PE ratio. But like Best Buy, Allstate’s PE ratio is not bad when compared to the industry average of 13.87

Allstate’s chart looks promising. It is working its way up a steep increasing channel and has reached resistance around the $120 area. Prices are coming close to the bottom of the narrow channel which could cause prices to push through the resistance and continue upward. If not, I see downside to the $114 area.

Aflac (AFL)

Aflac provides supplemental health and life insurance products. It operates in the United States and Japan, offering cancer, medical, income support, whole life, term life, child endowment, accident, critical care, dental, vision, among other insurance offerings. Aflac’s debt levels and earnings show me that their dividend is extremely healthy and is ready to continue with their growth. Like Allstate, Aflac’s insurance business will churn out profits regardless of the market which I find particularly attractive right now.

Aflac’s chart is in a gradually increasing channel which it has stayed within since mid-august of 2021. The price has tested both the higher and lower bounds of the channel multiple times, leading me to believe it will continue into the near futures. However, we do need to keep in mind that Aflac recently reached a 52-week high and will need to push through that in order to maintain its upward momentum. We may see more downside to the bottom of the channel before we see another push for a high.

Conclusion

In this article, I screened for stocks that look like they will provide regular growing dividends while also having potential for capital gains. My screening criteria found 24 stocks which fit the mold, I then narrowed that list down to 3 based off of the attractiveness of the stock’s chart and my comfort with understanding the company.

I am long on all the stocks on this list. I will watch this list play out through the month and open new positions as opportunities present themselves, these chart analyses help us to be prepared for those buying opportunities. All 3 stocks are suitable for further research and my article is not to be taken as financial advice. Thank you for reading and feel free to leave any replies or questions you may have on here or on my socials.