This weekly market recap is brought to you by Koyfin, a powerful analytical tool that I am proud to partner with. Their platform is entirely customizable for whatever data you want to look at including stocks, ETFs, mutual funds, currencies, economic data releases (one of my personal favorites used often for these posts), crypto, and even transcripts of company events! Click the link above to get a special offer only for Dividend Dollar readers or go give my product review a read if you’re interested!

Dividend Dollars’ Outlook & Opinion

Last week we called to be ready to play either side as bullish momentum had a chance at continuing while the RSI levels and resistance was evidence enough to counterargue a down week. We ultimately had the down week, but didn’t go quite as low to the 4,300 level I had called out as we closed at 4,348 this week.

Mixed economic data, hawkishness from Fed Chair Powell’s two day testimony, and a number of central bank rate hikes gave investors plenty to digest and feel bearish about this week. However, in the grand scheme of things, the market is still looking like it’s in great shape. The S&P 500 is up over 13% so far in 2023. Historically, whenever SPX has ended June over +10%, the index has ended the year higher 82% of the time, gaining 7.7% on average.

Technicals wise, we fell out of the resistance area I had pointed out last week. The next key level will be near the 0.618 fib line, which coincides with the 2022 peak seen in August. The RSI that was exceptionally high last week has turned back lower out of overbought levels.

The selling that we saw last Friday, going into the holiday week was typical. The selling that we saw this week was also typical of a shortened holiday week, though it was spurred on by central bank rate hikes and growth concerns. However, rate hikes and growth concerns have been a constant in this market since we saw rate hikes start in early 2022. Therefore, a part of me thinks that this selling week we just had was a product of the timing of those factors. However, with inflationary and growth concerns coming to forefront again, the PCE reading and Q1 GDP final reading in the later week may be the ultimate deciders on if we have a red or green week next week.

Ultimately, I’m giving a mixed call again this week. If data is good, we could see a push back higher to levels we were at last week. On the other hand we could get pushed back down to that 4,315 area and see if support holds.

Weekly Market Review

Summary:

This shortened holiday week saw $SPY and $QQQ break their winning streaks of 5 and 8 weeks. There was a sense that a pullback was due going into this week, so losses were primarily driven by profit-taking. Mega-caps continued to be relative out-performers, counter to the expected consolidation theme that many of us had. But selling was mostly non-tech related as the $RSP was down 2.7% while $MGK was only down 1%.

By the end of the week, concerns of growth and effects of rate hikes had entered the market’s narrative. Fed Powell said in his monetary policy testimony on Wednesday that there could be 2 more rate hikes before end of year. He continued his testimony on Thursday but that came with no new surprises, however the members of the senate banking committee did have thoughts on the capital requirements for banks, which sliced the performance of bank stocks this week.

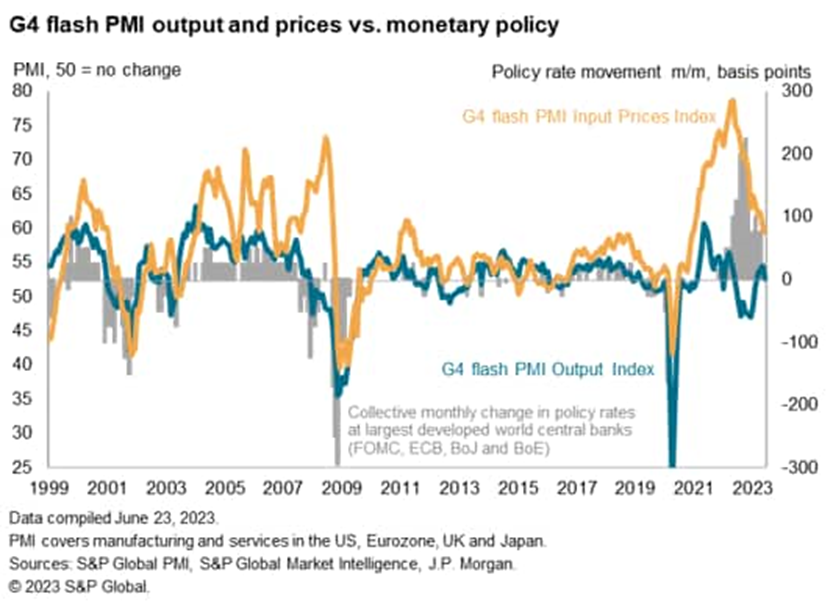

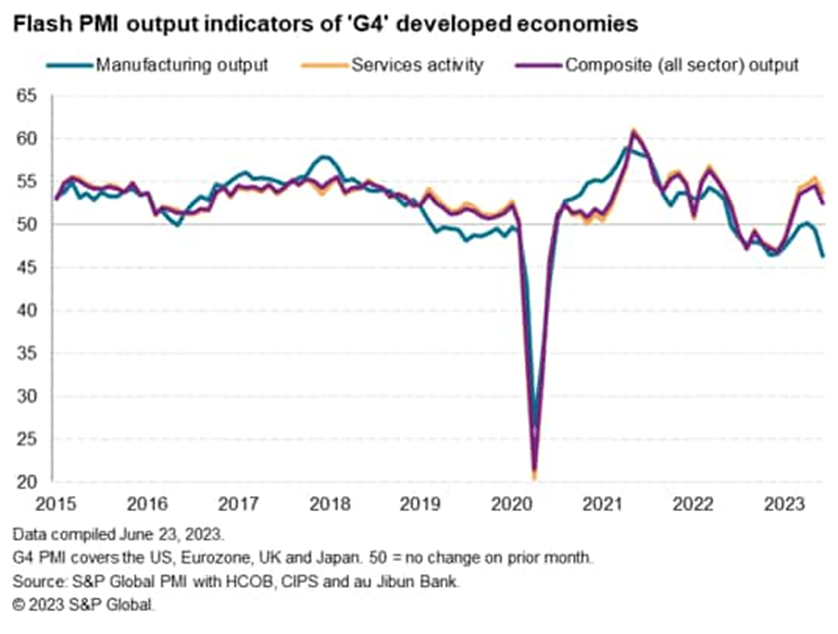

Several central banks announced increases this week included the BOE, Norges Bank, Swiss National Bank, and Central Bank of Turkey, lighting up global growth concerns. To add to the concerns, manufacturing PMI’s came in for Japan, Germany, the US, and the Eurozone which all came in under 50 (the contraction level).

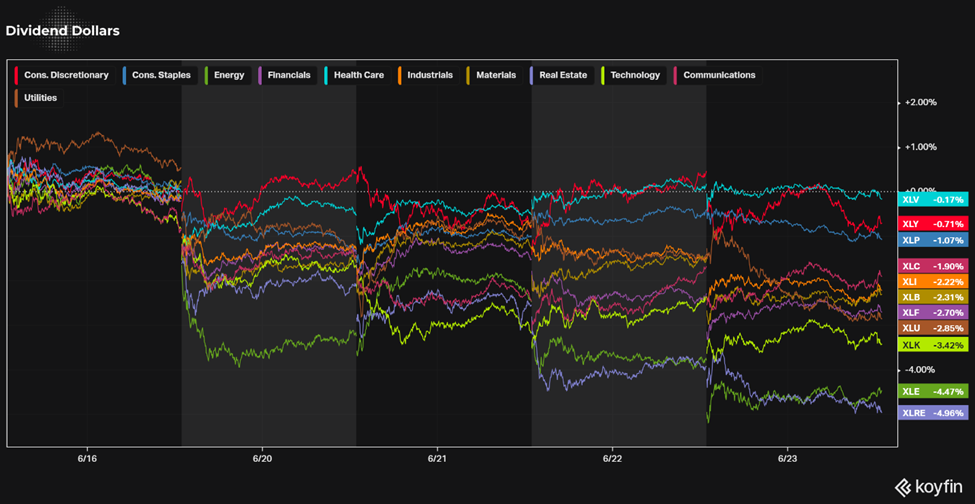

No sectors of the S&P 500 made gains this week. Healthcare was the closest to being green, while real estate, energy, and technology were the biggest losers.

Monday:

No news, Federal Holiday. YAY!

Tuesday:

The week started on Tuesday with widespread selling that was driven by pullback sentiment. The major indices were able to close higher than their lows for the day thanks to end of day strength in mega-caps. $MGK was down by 0.9% at the most and closed at 0.1% while $RSP was down by 0.9% at the most and closed down 0.5%.

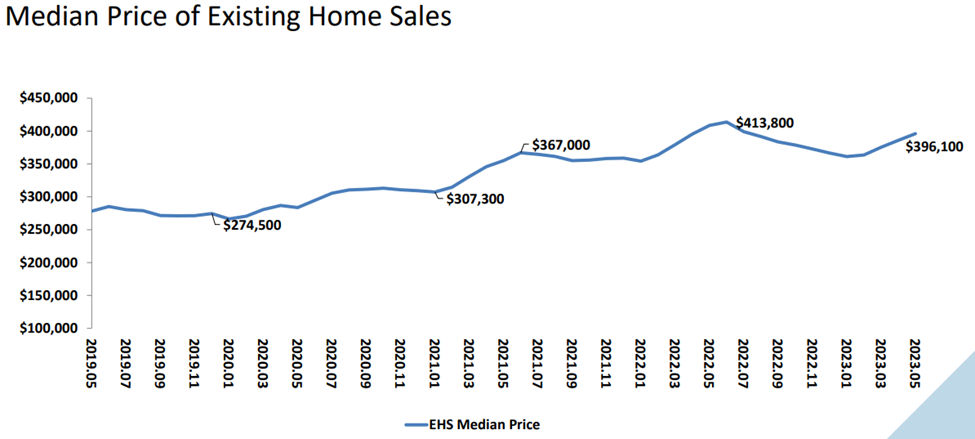

Homebuilder ETFs like $ITB and $XHB were up strongly due to better than expected housing for May. Total housing starts were up 21.7% MoM to an annual rate of 1.631M, above the 1.4M expectation. The prior month’s reading was 1.34M, creating the strangest pace of starts since April 2022. Total building permits were up 5.2% MoM to 1.491M, above the 1.417M reading last month. The takeaway from the report is that single-unit permits (typically a leading indicator) grew by 4.8% and single-unit starts were up 18.5%. This is a good sign for a supply-challenged housing market and homebuilders’ profits.

Wednesday:

Again, price action for Wednesday was driven by mega-caps and consolidation sentiment. Investors were also digesting Powell’s semiannual testimony before the House Financial Services Committee. His comments weren’t too surprising and did not move the market much. He reaffirmed the fact that there is still lots of work to do to get inflation down to the target and that most Fed members anticipate additional tightening this year.

The market had an early slide in the day. A rebound effort occurred in the afternoon as Treasury yields fell due to a $12B 20-year bond reopening at 1:00 PM EST causing stocks to rise on the lower rates. The 2-year rate fell 9 basis points before settling at 4.71%. The 10 year fell 8 basis points and settled at 3.72%.

Data for the day only involved the weekly MBA Mortgage Application Index which was up 0.5%. Purchase applications were up 2.0% while refinancing was down by the same amount.

Thursday:

The market was mixed on Thursday as there was broader consolidation efforts on growth concerns and general market support in the mega-caps. $MGK rose 1.1% while the major indices closed near their best levels of the day. However, the $RSP fell 0.4%. Market breadth is showing some negative action under the hood as decliners in the NYSE lead with a 2 to 1 margin. That margin was 2 to 3 at the Nasdaq.

The underlying growth concerns were in response to rate hikes from the Bank of England, Norges Bank, Swiss National Bank, and the Central Bank of Turkey. Powell’s continued testimony indicated that there could be two more rate hikes by the Fed before the end of the year. Afterwards, Fed Governor Bowman also stated today that “additional policy rate increases will be necessary to bring inflation down.”

Powell’s testimony, again, didn’t have any surprises. However, the committee did surprise with some member commentary focusing on increasing capital requirements for large banks, particularly those over $100 billion in assets. This brought about some selling in the sector as $KBE and $KRE both fell around 3% on the day.

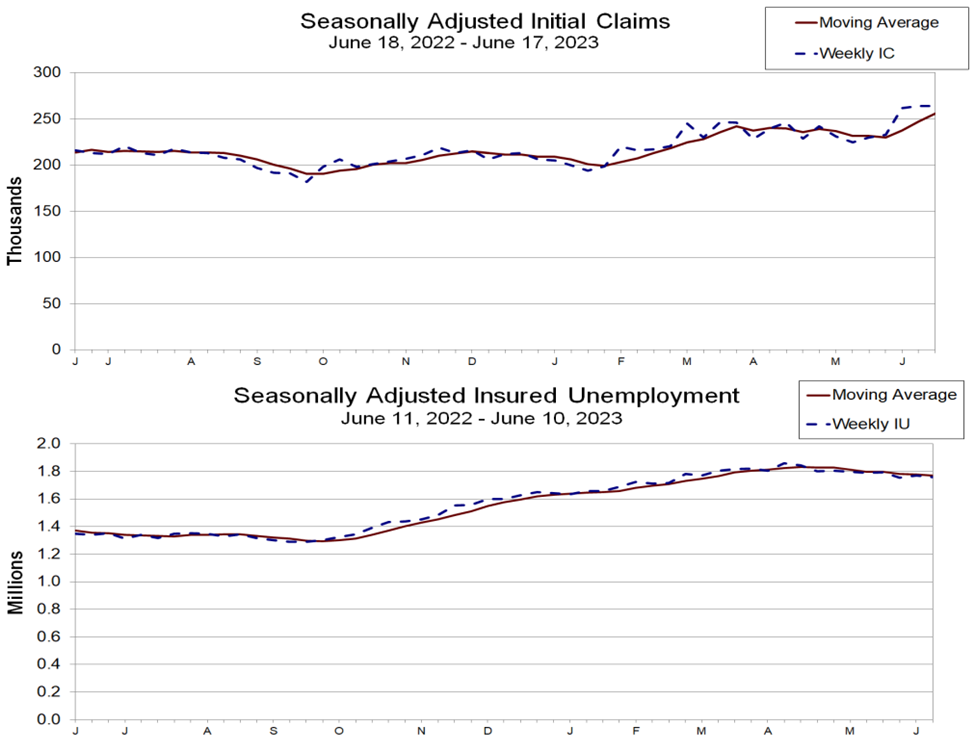

Economic data for the day included the initial jobless claims and existing home sales. Initial jobless claims for the week were flat at 264,000. The four week moving average was 255,750 and is the highest it’s been since November 2021. The continuing claims fell by 13,000 to 1.759 million. The takeaway here is that initial claims have remained higher than normal for 3 straight weeks suggesting there is some loosening happening. However, the level of claims is still well below levels seen in prior recessions.

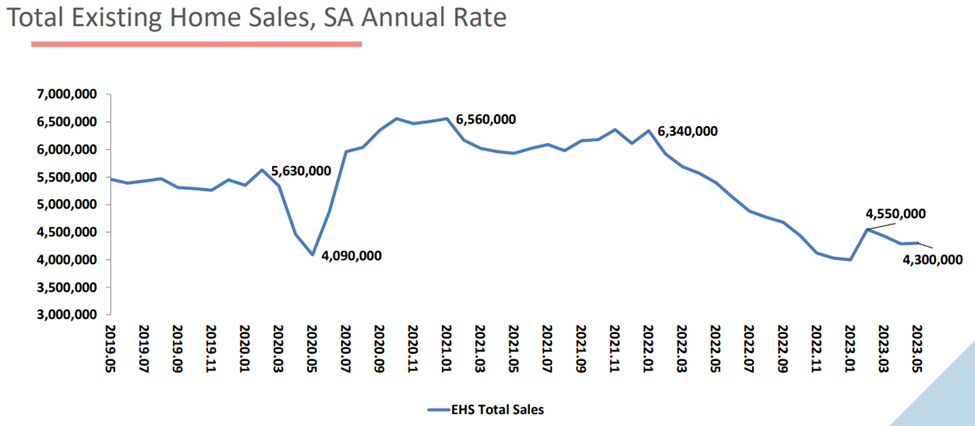

Existing home sales grew 0.2% MoM in May to an annual rate of 4.3 million, compared to an expected 4.28. Sales were down 20.4% compared to this time last year. Inventory of existing homes for sale is still tight, which is due in part to the strong labor market, the ability to work from home, and high mortgage rates deterring existing owners from transacting.

Friday:

The market closed the week on a defeated note. Consolidation efforts contributed to some weakness in the day, though global growth concerns were another contributor. Rebounds were attempted, but cut short. The major indices were all down between 0.7% to 1.4% for the day.

The downside moves followed a slurry of unimpressive Manufacturing PMIs for Japan, Germany, the UK, the Eurozone, and the US. All of the readings came in under 50 (contractionary level). This news paired with the central bank hikes on Thursday fueled worries of economic activity.

The G4 Flash PMI survey for June showed business activity grew for the 5th month in a row. However, the rate of growth slowed from May’s 13 month high to the weakest reading since February. The slowdown was led by manufacturing where output fell for the 12th time in the last 13 months. The services sector continued its expansion for the 5th straight month, though it appears to be losing momentum.

That’s it for my recap! If you would like to see how I am building my dividend portfolio using my predictions/strategy written here, you can read about my buys in my weekly portfolio update on this link.

And if you like updates like this, follow my Twitter or my CommonStock page where I post updates on the economic data throughout the week. I have also started a Twitch Channel called Games N Gains! Every Thursday at 6PM MST I go live to hang out, play games, and chat with y’all about stocks, charts, fundamentals, and anything else you like! I hope to see you in there!

Regards,

Dividend Dollars