This weekly market recap is brought to you by Koyfin, a powerful analytical tool that I am proud to partner with. Their platform is entirely customizable for whatever data you want to look at including stocks, ETFs, mutual funds, currencies, economic data releases (one of my personal favorites used often for these posts), crypto, and even transcripts of company events! Click the link above to get a special offer only for Dividend Dollar readers or go give my product review a read if you’re interested!

Dividend Dollars’ Outlook & Opinion

Last week I was personally bullish, so that didn’t work out for me. But the bearish cases I gave you were spot on. We mentioned that markets tend to pivot at the start of a new quarter, we saw that very clearly this week. I also gave bearish targets of 4,380 and 4,300. The low of this week nearly perfectly hit the first mark at 4,385. It is hard to be spot on with these outlooks, that’s why keeping an eye on both cases is important, because one side of our outlooks tend to be scarily accurate.

This was a busy week for economic data, especially with it being a shortened holiday week as much of the market took the 4th as opportunity to have a 4 day weekend. We had a smattering of employment data figures, most of which supported the soft-landing narrative but also left rooms for concerns of additional rate hikes.

Last week, the technicals and indicators really only provided a break-out signal, but it was not clear in which direction. Monday gave us a little bit of a fake out as price action hit a new bull-market high of $4,456 and then we ultimately ended the week with just under a 1% loss. The new bull-market high has moved the -10% correction line up to $,010 and the -20% bear market line up to $3,564.

Bull/Bear markets are defined by up/down moves of 20%, at that point they are backdated to the last low/high point. Since we hit a new high on Monday, the market is up 24.6% since the start of the bull market on 10/12/22 and has lasted 264 days, both the weakest and shortest bull market to have occurred since WWII. Does it still have more in the tank?

Next week we have the CPI reading on Wednesday and PPI reading on Thursday. Same as last week, there was roughly an equal number of upgrades and downgrades on sentiment indicators. VIX OI and equity OI improved while VIX, VIX IV, and SPX OI put call ratio worsened. There’s still plenty of potential pullback catalysts on the way, but bullish momentum is also a strong counterbalance. The chart bounced perfectly at the bottom of the channel on Thursday, confirming my support in the area. I am neutral coming into next week, I’d like to see strong movement in either direction to break the red channel and then follow the trend in whichever direction is setting it for next week.

Weekly Market Review

Summary:

The shortened week started out slow for the market, as expected with the 4th pushing lots of investors to take a 4-day weekend. After the holiday there were some catalysts that encouraged investors to pull out some money after the strong start to the first half of this year.

Geopolitical and global growth concerns were present in the early week following PMI readings that were weaker than expected for China and Europe. Later in the week, rising treasury yields were a big factor in driving stock sales following the stronger than expected ADP employment figures for June.

The bump in rates increased valuation concerns in the market as the possibility of another Fed rate hike grew. The fed funds futures market still sees only one more hike on the horizon. The FedWatch tool shows that there is a 93% change of hike this month, followed by 24%, 34%, and 30% chance of a second hike in the following three meetings of this year.

Another rate hike, and potentially increased chances of a second rate hike depending on incoming data, makes it harder for stocks to compete with the risk-free rate. This creates headwinds for stocks, so we always want to keep an eye on it. Obviously it’s been on my mind since my girlfriend told me I was sleep talking about interest rates last night!

Overall, only one sector made gains this week. Real Estate was the stand out S&P 500 performed with a +0.2% gain meanwhile Healthcare, materials, and IT were all the worst losers with losses ranging from 2.9% to 1.5%.

Monday:

The market closed early today and marked the start of a new month, quarter, and half of the year on a slightly higher note. Volume was light but decent for a shortened day. Conviction was lacking as the market was absent many traders.

EV makers $TSLA and $RIVN were top standouts for the day after impressing with Q2 delivery numbers. The Regional Banking ETF $KRE rose 2.3% following capital return plans announced by some banks after the stress test results.

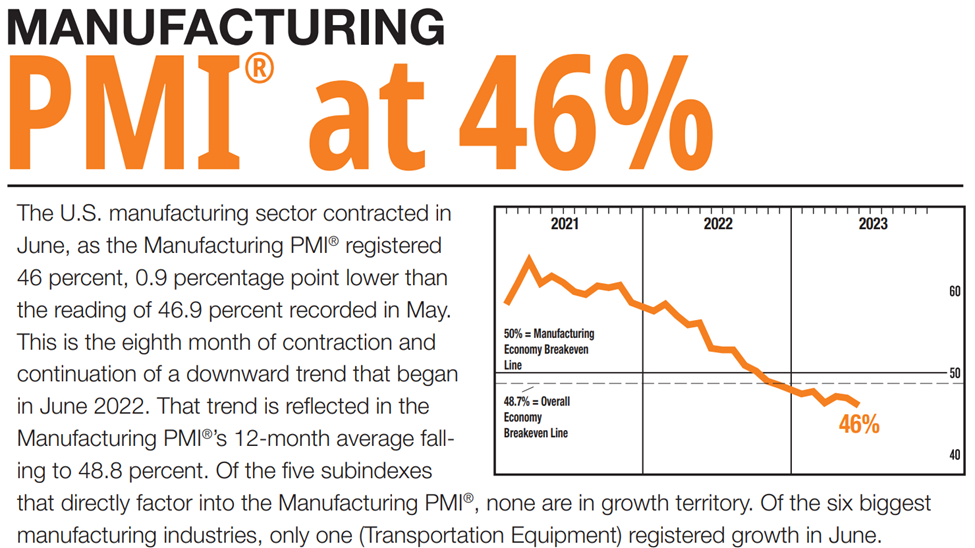

Data for the day included the June ISM Manufacturing Index and the Total Construction Spending report. The June ISM Manufacturing Index fell to 46% compared to an expected 47.1% and a prior 46.9%. The sub-50% reading reflects a general contraction for manufacturing activity for the 8th straight month.

Total Construction Spending increased 0.9% MoM compared to an expected 0.4% and prior 0.4%. Total private construction was up 1.1% MoM while total public construction rose 0.1%. There is renewed strength in new single family construction which reflects the pick up in demand for housing despite the jump in mortgage rates (a top we have discussed in the Games N Gains twitch stream).

Tuesday:

Happy 4th of July!

Wednesday:

The major indices all hit losses this day with several catalysts bringing traders to take some money off the table. The Services PMI reading for June from China and Europe were weaker than expected, the US had headlines that they’re looking to restrict China’s access to cloud computing, and China said foreign entities must request permission to export certain materials.

There was also some selling in wake of the release of the FOMC Minutes for the June meeting. The minutes weren’t surprising though and the markets quickly bounced back. Ultimately, this day ended close to where the indices were trading before the minutes were dropped.

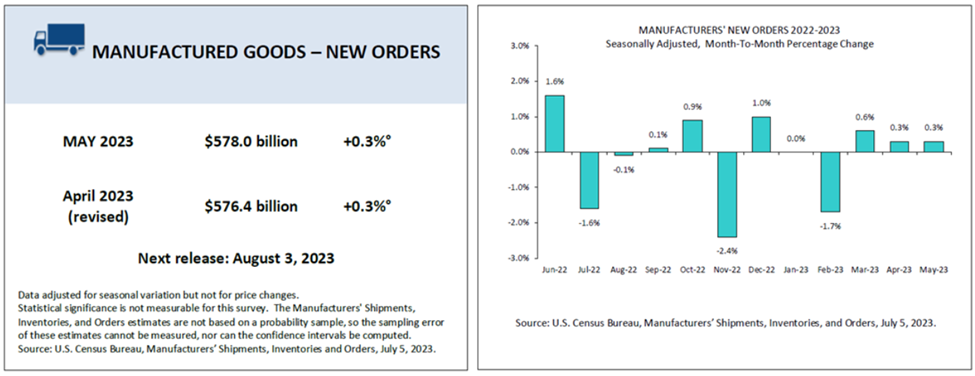

Data for the day included only the Factory Orders. They increase 0.3% MoM compared to a 0.6% consensus and prior 0.3%. Excluding transportation, the reading fell by 0.5% MoM after a 0.6% decline in April. Shipments of manufactured goods also grew 0.3% MoM after falling 0.6% in April. This all shows new order activity continues to be week, excluding transportation.

Thursday:

This was another losing day with a little rebound from the lows. Rising Treasury rates were a big factor in the stock retreat for the day. The 2 year note yield rose 5.01% and the 10 year not yield rose to 4.04% in response to the strong labor data and stronger than expected Non-Manufacturing ISM report. These moves caused higher probabilities and concerns of another Fed hike at the next meeting.

Economic data for the day included the ADP jobs report, initial jobless claims, the Jolts job openings report, the trade balance report, and the ISM Non-Manufacturing index report for June.

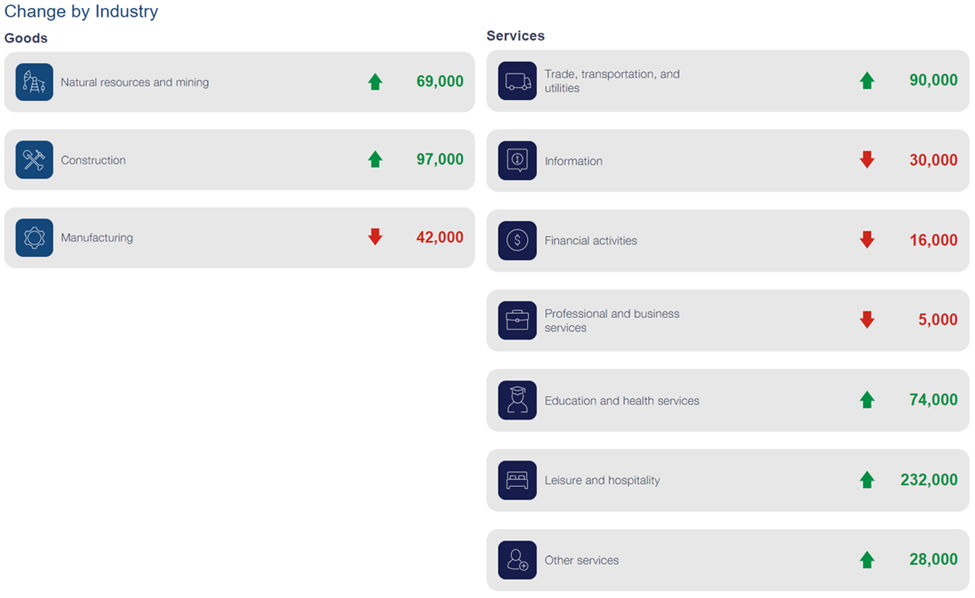

The ADP report showed private sector hiring increased by 497,000, a huge increase on 245,000 expectations and 267,000 prior reading. Service sectors surged with 373,000 adds. Small and medium businesses led the hiring with gains of 299,000 and 183,000. JOLTS job openings totaled 9.824M following the 10.32M from April. Initial jobless claims increase by 12,000 to 248,000, just slightly above the consensus of 245,000. Continuing claims fell by 13,000. The leading indicators from all job reports continue to come in lower than recessionary levels.

The May Trade Balance Report showed a shrinking deficit to $69B, in line with expectations and below the prior $74.4B reading. This is a move in a good direction, but not because of any overwhelming strength in exports, which were actually less than the prior month’s. The swing factor was that imports were $7.5B less than the prior month. The decrease in imports and exports shows softening global demand that we would expect to see in a global rising rate environment.

Lastly, the ISM Non-Manufacturing Index hit 53.9%, above the expected 51.1% and prior 50.3%. This increase suggests activity in the services sector is picking up steam and comfortably places the index above the 50% contraction/expansion line. This growth in services is a trend that could cause hard-landing concerns and presumably could contribute to the Fed’s inclination of additional hikes.

Friday:

The market looked better today, however, things worsened in the afternoon when some mega-caps rolled over into the red. Gainer led losers by a 5 to 2 margin on the NYSE and a 2 to 1 margin on the Nasdaq. Small caps and value stocks showed relative strength, reflecting a shift in growth mentality.

Data for the day included the nonfarm payrolls which increased by 209,000, compared to an expected 220,000 and a prior decrease of 110,000. Average hourly earnings increased by 0.4%. This still fits the soft-landing narrative as payroll growth slowed but still remained positive.

That’s it for my recap! If you would like to see how I am building my dividend portfolio using my predictions/strategy written here, you can read about my buys in my weekly portfolio update on this link.

And if you like updates like this, follow my Twitter or my CommonStock page where I post updates on the economic data throughout the week. I have also started a Twitch Channel called Games N Gains! Every Thursday at 6PM MST I go live to hang out, play games, and chat with y’all about stocks, charts, fundamentals, and anything else you like! I hope to see you in there!

Regards, Dividend Dollars

One reply on “Weekly Stock Market Recap & Outlook (7/7/23) – A Bumpy Start to Q3”

[…] is it for the update this week. Check out this week’s Market recap and outlook to prepare for the week […]