This post by Koyfin, a powerful analytical tool that I am proud to partner with. Their platform is entirely customizable for whatever data you want to look at including stocks, ETFs, mutual funds, currencies, economic data releases, crypto, and even transcripts of company events! The charts you can make are incredible (as you’ll see here). Click the link above to get a special offer only for Dividend Dollar readers or go give my product review a read if you’re interested!

Dividend Dollars’ Outlook & Opinion

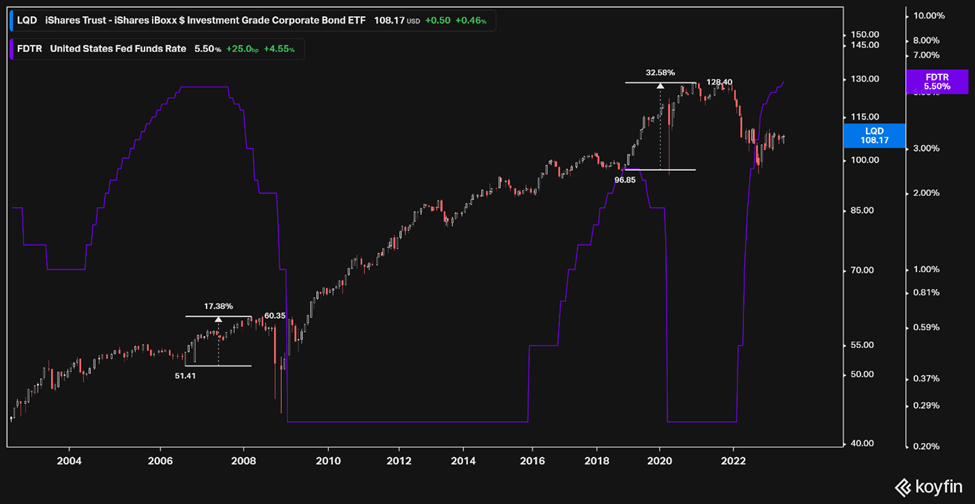

On July 26th, 2023, the Fed hiked rates another 25 basis points after pausing the hikes one month prior. This hike constituted 11 rate increases in the last 12 Fed meetings, moving rates from near 0 to 5.50% in roughly a year and a half. Absolutely bonkers jump in rates!Many economists and forecasters are expecting that July’s hike may be the last. According to the CME FedWatch Tool, there is a less than 35% chance of another hike occurring through the end of this year and a less than 20% of another hike occurring at all in the next year.

So with rates potentially hitting a peak here, what does that mean for interest rate sensitive assets like bonds? Well, history has shown that there is on average a ~1% drop in bond yields over the next 12 months following an interest rate pause. Regardless of whether the July hike was the last one or not, that means that there is a fairly good chance that we will see lower bond yields within the next year. This is particularly true given the fact that the 10-year treasury yield is nearing heavy resistance as it approaches its recent highs in this cycle.

If the rate rejects new highs and the Fed is in fact paused (or approaching a pause), the 10-year yield should drop if historical actions have any say in the matter. This will be good bonds, particularly intermediate term bonds.So I started to look around for some bond ETFs to back test this theory. I found $LQD, $BND, $AGG, and $BIV all had decent gains over the 12-24 months the pauses in the two rate hike cycles that they have experienced. View the charts below.

After seeing this, I determined that it might be throwing a bond ETF into my portfolio for the next 12-24 months to gain some exposure to this phenomenon. Just yesterday, I added $AGG to my portfolio with a starting position of 5 shares. I decided to write this article to deeper explain the reasoning than you would read in my weekly portfolio updates. I also wanted the readers to get this information as soon as possible!

I’ve decided to keep my spare cash in the position and will not hesitate to pull it out and put it to use within my core holdings. But in the meantime, I am hoping to catch this less risky appreciation and cash flow from the yield of this fund! Truth be told, I have very little experience with bonds, but the logic here seems too sound to pass up!That’s it for this post! I am about to go live on the Games N Gains twitch stream to discuss the $APD and $CMI earnings calls and play some games. So pop in and hang out right here: https://www.twitch.tv/gamesngain.