Welcome back to the weekly Dividend Dollars portfolio review! This post is brought to you by Koyfin, a powerful analytical tool that I am proud to partner with. Their platform is entirely customizable for whatever investment data you want to look at. I wouldn’t use any other website to dive into a stock’s fundaments. Click the link above or picture below to get a special offer only for Dividend Dollar readers or go give my product review a read if you’re interested!

Here at Dividend Dollars, our investing approach is a dividend growth strategy with aspects of value investing and fundamental analysis, plus some option writing on the side. I am a young investor in my 20’s and by sticking to this strategy over the long term, the magical powers of compounding are on my side. This allows me to more easily build substantial positions in dividend paying stocks over time, which will one day help me reach the ultimate goal of being financially free through the sources of passive income they provide. You can read more about the strategy here.

Now onto the portfolio review for this week!

Portfolio Value

To date, I have invested $21,550 into the account. The total value of all positions plus any cash on hand is $24,900.71. That’s a total gain of 15.55%. The account is down $248.05 this week which is a loss of 0.99%. We contributed $90 in cash to the account this week.

We started building this portfolio on 9/24/2021 and when compared to the S&P 500 we are outperforming the market, just barely! Within that same timeframe, the S&P 500 is up 15.00%, which puts us 0.55% higher than the market! See the comparison in the dashboard below.

Portfolio

Above is a dashboard of the portfolio that tracks all positions, portfolio diversification, performance compared to the S&P 500, income from dividends and options, and projected dividend income. In the time I have been gone, my PADI has increased from $412.17 to $416.80!

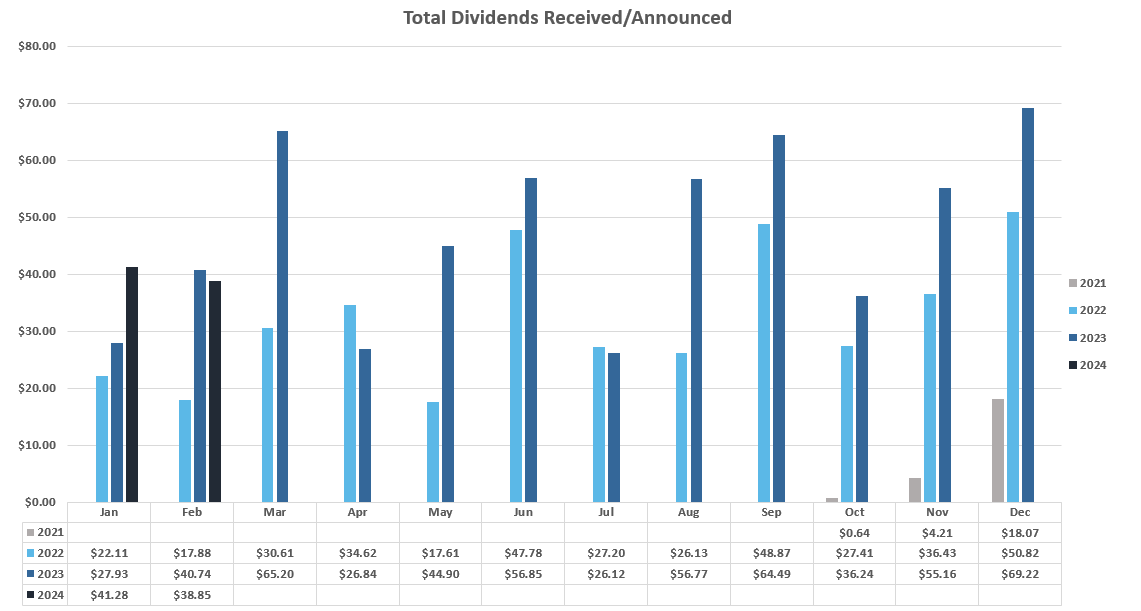

Dividends

This week I received one dividend from $CMI for $9.13

Dividends received/declared for 2024: $115.46

Portfolio’s Lifetime Dividends: $1,084.69

Trades

Though it was a down week it was a decent one! We added to our core ETFs, made on opportunistic add to $NSSC on the news of the CEO selling shares, and we made some good option selling trades, the best of which was that $SNAP went back in the money, allowing us to exit with gains after the earnings report caught us hanging. Below are the details of all the trades for the week:

- March 5th, 2024

- SPDR S&P 500 ETF ($SPY) – added 01. Shares at $507.90

- Invesco S&P 500 Momentum ETF ($SPMO) – added 0.75 shares at $58.76

- Siren DIVCON Leaders ETF ($LEAD) – added 0.8 shares at $64.80

- Proshares UltraPro QQQ ($TQQQ) – Sold to open $52 3/15 put for $41

- March 6th, 2024

- Proshares UltraPro QQQ ($TQQQ) – Bought to close $52 3/15 put for $21, 49% win

- NAPCO ($NSSC) – added 10 shares at $39.80

- March 8th, 2024

- Cummins ($CMI) 0 dividend reinvested

- Snapchat ($SNAP) – Bought to close $12.5 3/8 put for $13 (This $SNAP campaign first brought in $18 on my 2/16 put, which went against me and earned me $19 to roll it out to 3/8, and then cost me $13 to close resulting in a total $24 win)

We have no options currently open, closed them all this week! We will look to sell more next week.

That is it for the update. Let me know what you think of the progress so far, share with me your progress and questions, interact with me on Twitter and CommonStock as well as the other socials using the links below!

Thank you for reading! See you next week and stay safe!

Regards,

Dividend Dollars

This post is brought to you by Sharesight, a portfolio tracking tool that I am happy to partner with. Their platform makes tracking trading and dividend history, understanding your performance, and saving time a breeze. I wrote a review of the product that you can read here if you’re interested in learning more! Click the link above or the picture below to get a special offer only for Dividend Dollar readers!