Welcome back to the weekly Dividend Dollars portfolio review! This post is brought to you by Koyfin, a powerful analytical tool that I am proud to partner with. Their platform is entirely customizable for whatever investment data you want to look at. I wouldn’t use any other website to dive into a stock’s fundaments. Click the link above or picture below to get a special offer only for Dividend Dollar readers or go give my product review a read if you’re interested!

Here at Dividend Dollars, our investing approach is a dividend growth strategy with aspects of value investing and fundamental analysis. I am a young investor in my 20’s and by sticking to this strategy over the long term, the magical powers of compounding are on my side. This allows me to more easily build substantial positions in dividend paying stocks over time, which will one day help me reach the ultimate goal of being financially free through the sources of passive income they provide. You can read more about the strategy here. Let’s dive into the portfolio review!

Portfolio Value

To date, I have invested $19,195 into the account. The total value of all positions plus any cash on hand is $19,890.29. That’s a total gain of 3.62%. The account is up $1,238.82 this week which is a +6.64% gain. We added $145 in cash to the account this week, trades made will be broken out below.

We started building this portfolio on 9/24/2021 and when compared to the S&P 500 we are outperforming the market so far! Within that same timeframe, the S&P 500 is down -2.18% which puts us 5.80% higher than the market!

Portfolio

Above is a dashboard of the portfolio that tracks annual dividend income, yield, beta, dividend growth, and more.

Below is a table of everything we are invested in so far. There you can see my number of shares, shares bought through dividend reinvestments, average cost, gains, and more. The tickers in green are positions that I bought shares in this week, the blue ones are positions that I reinvested dividends into, the yellow ones are positions that announced a dividend increase this week, and the red are positions that I trimmed. Our PADI increase from $672 to $679!

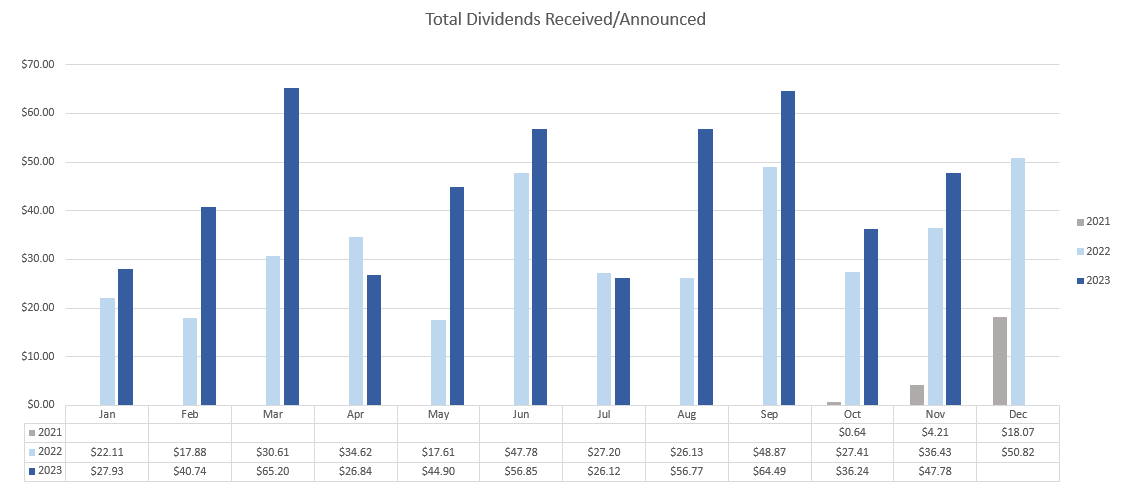

Dividends

Over the last week I received two dividends: $1.92 from $SPY and $38.17 from $T

Dividends received for 2023: $484.27

Portfolio’s Lifetime Dividends: $894.68

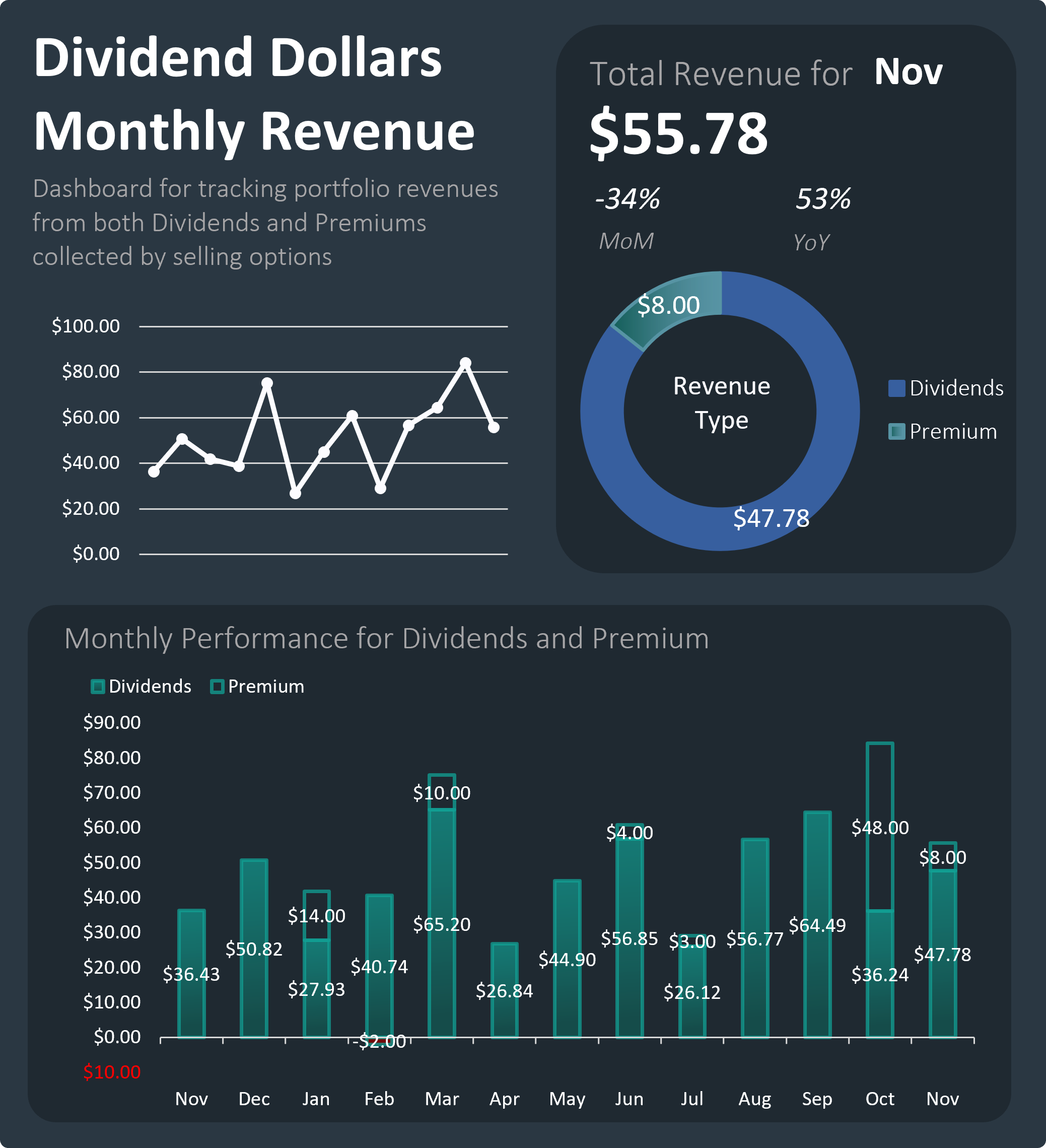

I tried to build a dashboard of sorts for tracking income from dividends and option premium since I’m starting to try out option selling. Check out that other graphic below and let me know what kind of tracking you like better!

Trades

This week was a killer week, with nearly a 5% swing higher in $SPY! Our account got carried higher with the market, but we also had a good number of outperformers with $SBUX, $IBP, $BAC, $CMCSA, $EGP, $INTC, $T, and $MMM all having returns of +7% for the week.

Earnings is in full swing, I’ve spent some time reviewing the reports for $TXN, $EGP, and $LPLA. I liked $LPLA’s report a lot as you can see it was one of my only adds this week. $O also provided a great dip buying opportunity early in the week with the poor reception to the announced acquisition of $SRC.

Those were my only two buys, we had reinvested dividends in $T and $SPY, and executed a few option sales. Below is a detailed breakdown of all trades this week:

- October 30th, 2023

- SoFi Technologies ($SOFI) – Closed $6 11/3 cash secured put for $0.04, $13 or 76% gain.

- AT&T ($T) – Sold $16 11/10 covered call for $0.08.

- October 31st, 2023

- Realty Income ($O) – Added 1.3 shares at $47.

- SPDR S&P 500 ETF ($SPY) – Dividend reinvested.

- November 1st, 2023

- Direxion Daily Semi Bull 3X ($SOXL) – Closed $12.5 11/3 cash secured put for $0.02, $11 or 84% gain.

- AT&T ($T) – Dividend reinvested.

- November 2nd, 2023

- Marathon Digital ($MARA) – Sold $7.5 11/10 cash secured put for $0.08.

- LPL Financial ($LPLA) – added 1 share at $222.52.

$SPY Swing Win!

Normally, this is where the weekly update will end, but I have another HUGE win to share on the blog that has happened in my options trading account.

I hardly ever write about my speculative day/swing trading account as my ability to consistently execute and win is pretty poor. I am more than willing to stomach some losses on my trading account as I treat it as a hobby and learning experience, others may not be so risk tolerant! I don’t want to inadvertently cause others unnecessary losses by sharing the riskier trades in my options account. Therefore, this may be the only time you see content like this on this blog.

With that disclosure now out of the way, last Friday I opened an aggressive swing on $SPY. At the time, $SPY was trading around $410-$415. I opened a 12/1 $423 call option for $5.12. At market close today, $SPY was at $434 and my option had risen 215% to $16.14. A $1,100 gain! I have not closed the trade yet as $SPY is sitting on a key Fibonacci level and I’d rather let that play out for a few more days or so before I close.

What triggered this trade for me was a tool called Toggle.AI. For weeks now, I’ve been messing around with this website that generates AI powered investing insights that are based on historical outcomes. They have used the aggregate number of insights at any given time to create a handful of indicators (Leading, Rangefinder, and Peak/Trough Probability). On a $SPY chart, I plotted when these indicators flashed bullish and compared the next 2-3 week returns to a $SPY call with >30 days expiration at was OTM by >$8. What I found was that when enough of the three indicators are in bullish territory in a short period of time, those calls generally performed really well. Funny enough, after doing this analysis, a number of bullish indicators triggered last week, and I figured I would give it a shot! So, I opened the trade and it worked like a charm!

That is it for the update this week. Let me know what you think of the progress so far, share with me your progress and questions, interact with me on Twitter and CommonStock as well as the other socials using the links below! Also, tune into the Games N Gains Twitch Stream every Thursday at 6PM MST. I play games, hang out, and chat with y’all about stocks, charts, fundamentals, and anything else you like! I hope to see you in there!

Thank you for reading! See you next week and stay safe!

Regards,

Dividend Dollars

This post is brought to you by Sharesight, a portfolio tracking tool that I am happy to partner with. Their platform makes tracking trading and dividend history, understanding your performance, and saving time a breeze. I wrote a review of the product that you can read here if you’re interested in learning more! Click the link above or the picture below to get a special offer only for Dividend Dollar readers!